Key figures

Return

The fund’s value

The Executive Board’s assessment of the results

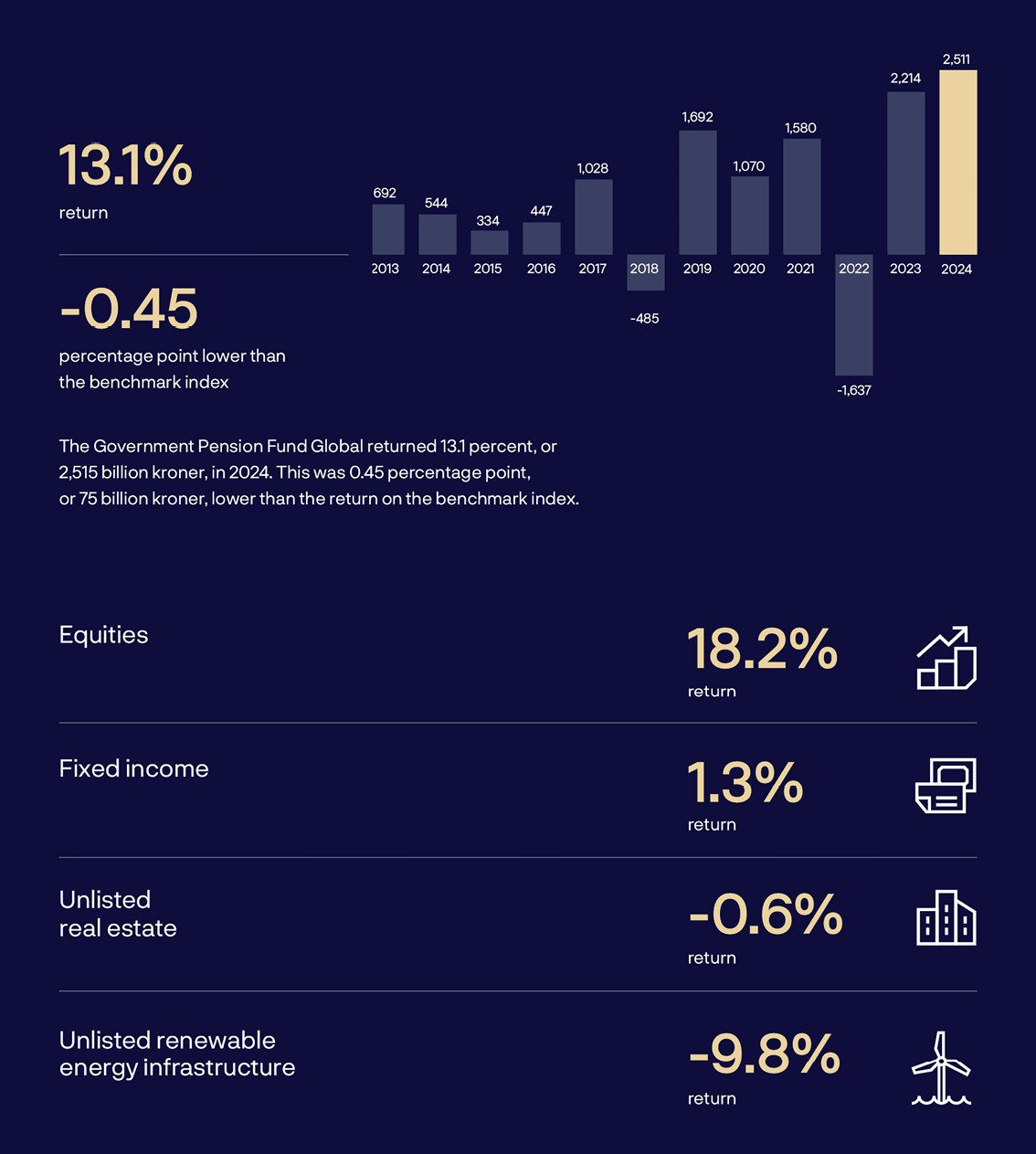

The investments in the Government Pension Fund Global returned 13.1 percent in 2024 following strong gains in global equity markets. Nevertheless, the relative return was weak, with a return that was 0.45 percentage point below the fund’s benchmark index. The Executive Board emphasises the importance of assessing results over time and is satisfied that the return over time has been higher than the return on the fund’s benchmark index.

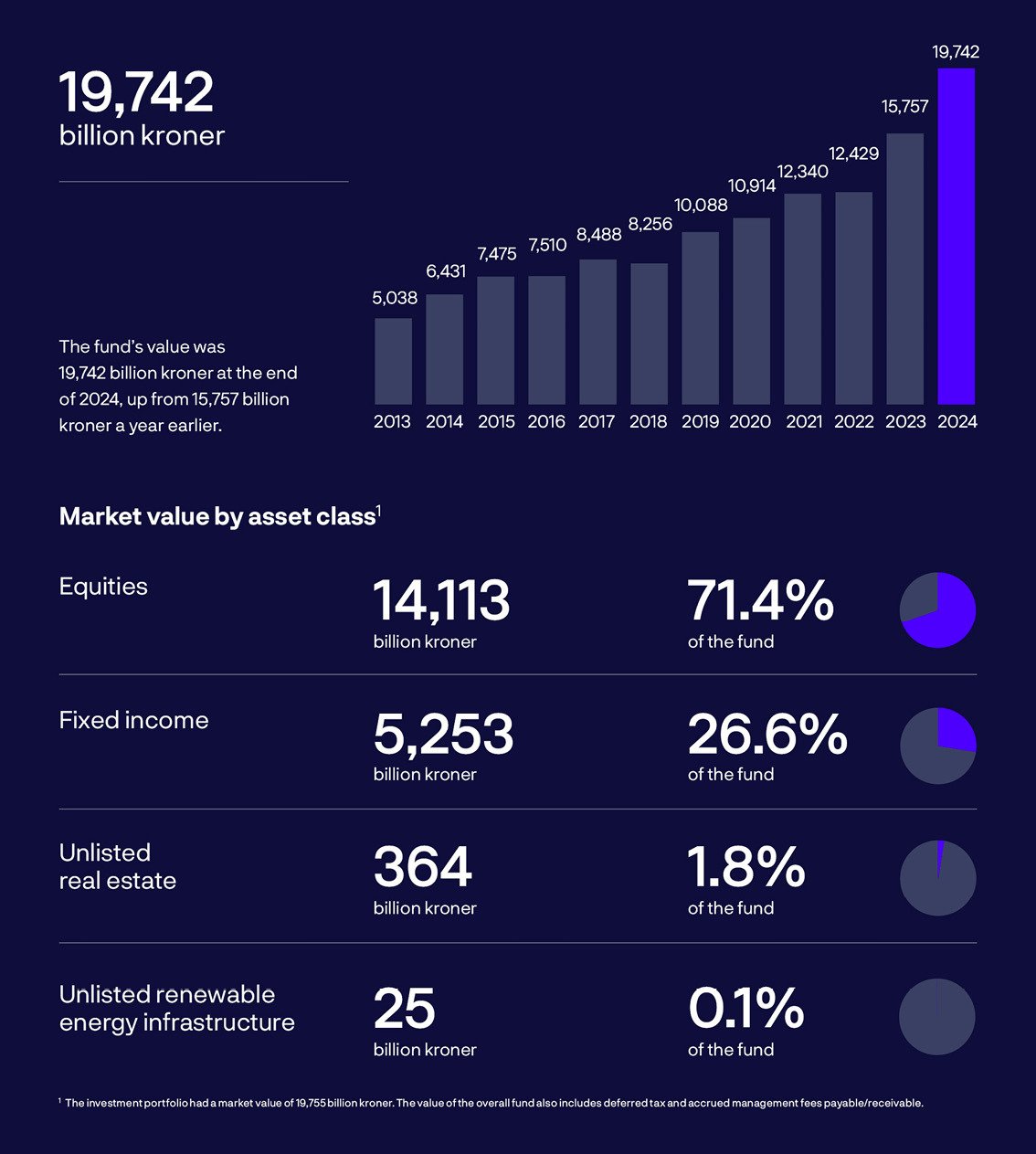

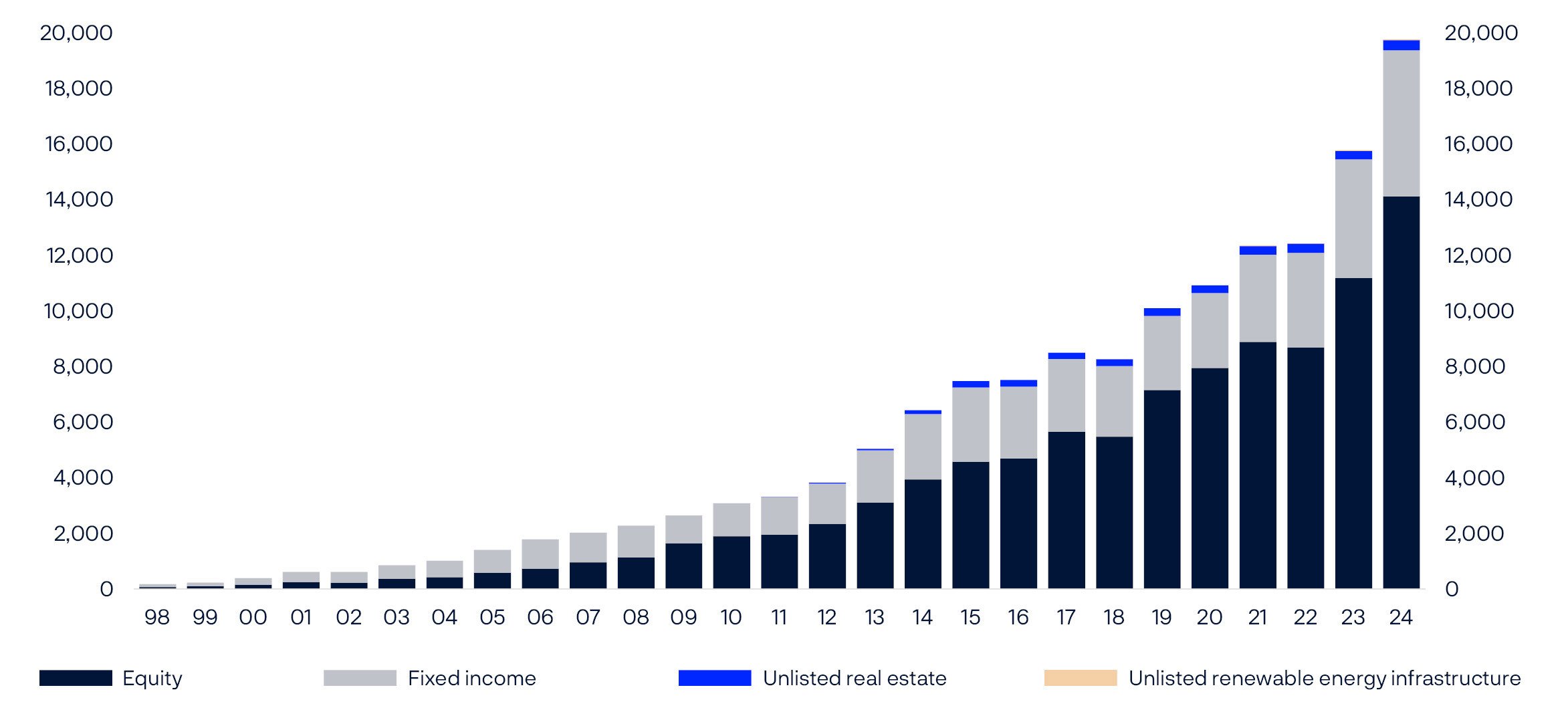

The fund’s value increased by almost 4,000 billion kroner in 2024, to 19,742 billion kroner. At the end of the year, the fund’s investments comprised 71.4 percent equities, 26.6 percent fixed income, 1.8 percent unlisted real estate and 0.1 percent unlisted renewable energy infrastructure.

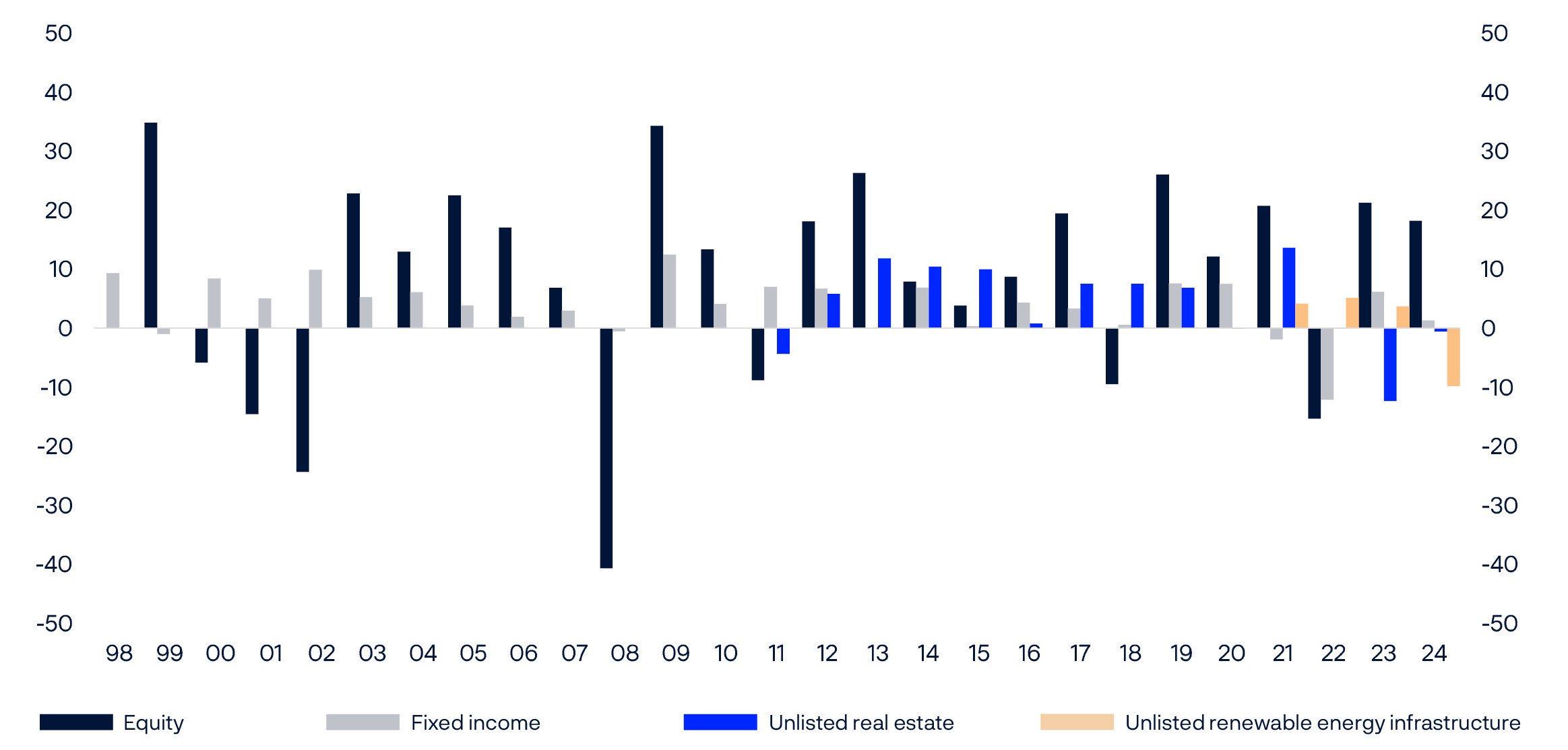

Measured in terms of the fund’s currency basket, the return for the year was 13.1 percent, or 2,511 billion kroner, before management costs. Equities returned 18.2 percent. Solid corporate earnings in the investee companies and more optimistic growth expectations, together with declining inflation expectations, led to strong equity markets. A small number of companies now account for a substantial share of the fund’s benchmark index, owing to developments in equity markets in recent years. Several of the largest companies are in the technology sector, which delivered the highest return in both 2023 and 2024.

Fixed-income instruments returned 1.3 percent in 2024 after bond yields rose somewhat over the year. Investments in unlisted real estate returned -0.6 percent. While valuations of many of the fund’s unlisted real estate investments fell considerably in 2023, developments were more mixed in 2024. The office segment in the US remained weak, while some other market segments performed more positively.

The fund’s investments in unlisted renewable energy infrastructure returned -9.8 percent. The return on these investments comprises the net income from the assets and changes in their value. Expected future power prices, expected future production volumes and the estimated cost of capital impact valuations. The value of the assets also falls as their expected remaining life decreases. In 2024, the negative return on unlisted renewable energy infrastructure was driven in particular by a higher cost of capital.

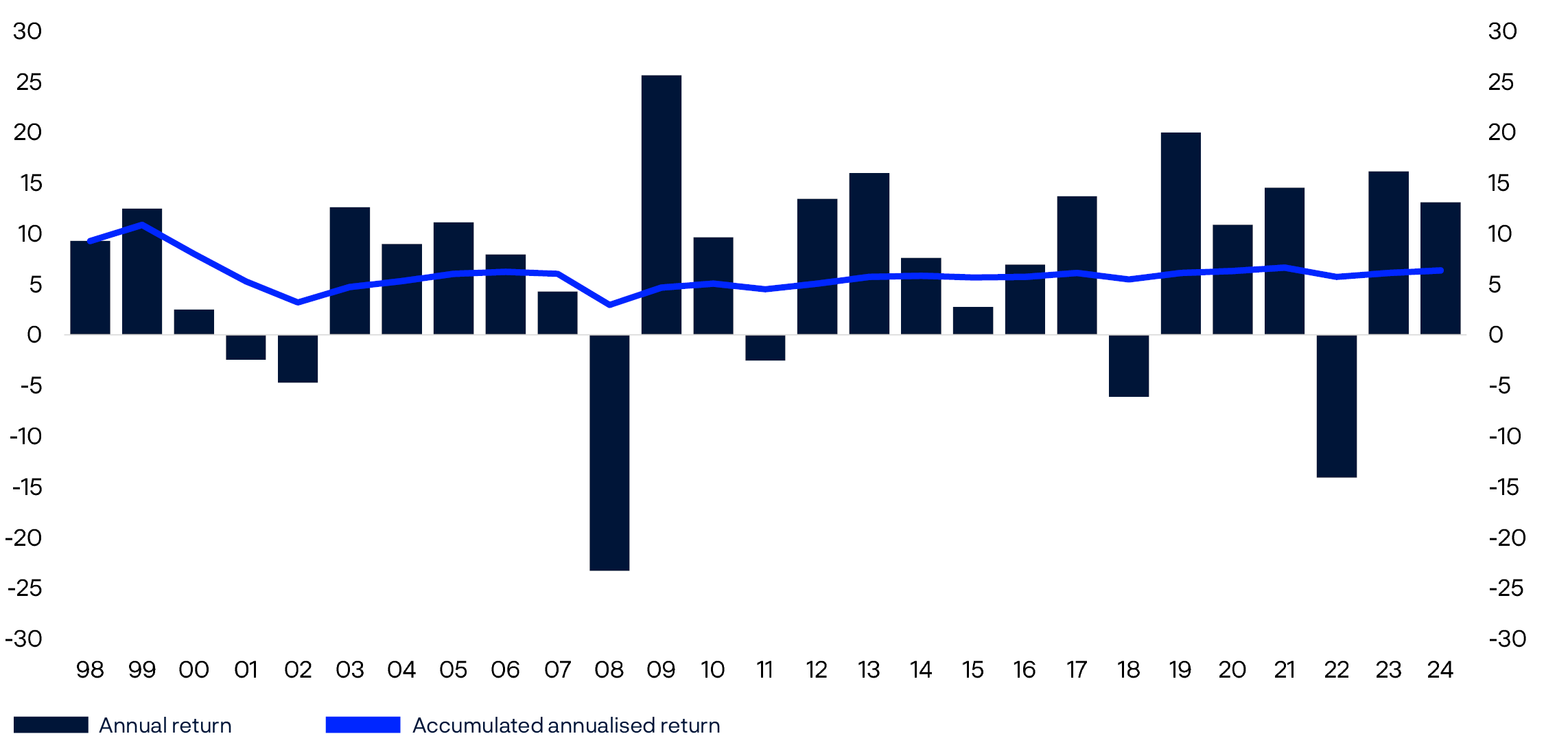

The Executive Board considers the overall return on the fund over time to have been good. In the period from 1998 to 2024, the average annual return was 6.3 percent. The annual net real return, after deductions for inflation and management costs, was 4.1 percent in the same period.

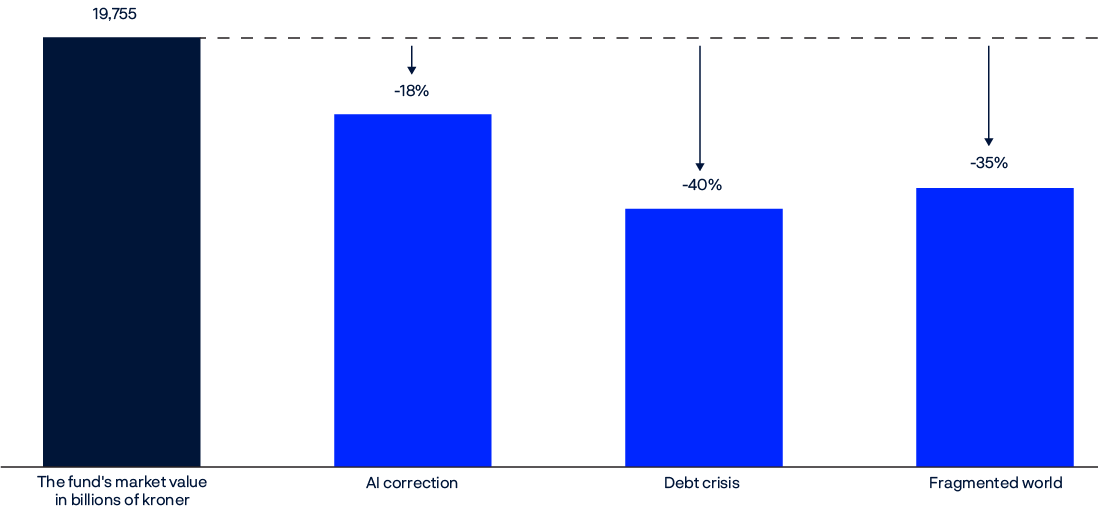

With such a large fund and an equity share of around 70 percent, we have to be prepared for considerable fluctuations in the fund’s return and value. Each year, Norges Bank publishes analyses of risk based on hypothetical scenarios designed to illustrate extreme market events over periods of up to five years. This year’s scenarios are related to a repricing of AI companies, a debt crisis and a more fragmented world of distinct economic blocs. The estimated decrease in the value of the fund in these scenarios ranges from 18 to 40 percent.

Norges Bank manages the fund with a view to achieving the highest possible long-term return, within the constraints laid down in the mandate from the Ministry of Finance. Results are measured against the fund’s benchmark index. In 2024, the return on the fund before management costs was 0.45 percentage point lower than the return on the benchmark index. This is within the range of variation in relative return that can be expected from one year to the next.

Norges Bank’s investment strategies are grouped into three main strategies: market exposure, security selection and fund allocation. These three strategies are complementary and aim to take advantage of the fund’s size and long investment horizon.

Under the strategy for market exposure, the fund is invested broadly in the equities and bonds included in the benchmark index. The investments are made cost-effectively and with a view to contributing to the objective of the highest possible return. Market exposure contributed positively to the fund’s relative return in 2024.

The strategy for security selection is based on fundamental analysis of companies, and Norges Bank uses both internal and external managers. In 2024, the overall contribution from security selection was negative. External management made a positive contribution, but the negative contribution from internal management was larger. The security selection strategy is not expected to contribute positively to the fund’s relative return every year, and the results for 2024 followed a period of five consecutive years of positive contributions from security selection.

Norges Bank invests part of the fund in listed and unlisted real estate and unlisted renewable energy infrastructure. These investments are funded by selling equities and bonds, and form part of the fund allocation strategy. In 2024, the investments in real estate returned less than the equities and bonds we sold to fund them, and therefore served to reduce the fund’s relative return.

Investments in unlisted renewable energy infrastructure returned less than the bonds sold to fund them. As these investments made up only a small part of the fund, this had only a minor impact on the fund’s overall relative return.

While unlisted renewable energy infrastructure is a relatively new investment area for Norges Bank, we have been investing in unlisted real estate since 2010. The Executive Board assesses results over time and against a wide range of return metrics, including developments in the broad real estate market.

In recent years, real estate returns have been characterised by two periods of particularly negative performance. This was after the outbreak of Covid-19 in March 2020 and the rise in interest rates that started in earnest in 2022. These events have led to a negative contribution to the fund’s relative return from real estate investment and the funding of such investment.

In 2024, the fund also had a slightly smaller allocation to equities and a smaller allocation to the largest US technology companies than the benchmark index. This served to reduce the fund’s relative return in 2024, as returns were strong in both the broad equity market and the technology sector. These positions are intended to adjust the fund’s overall risk profile and are reported as part of the fund allocation strategy.

The Executive Board emphasises the importance of assessing the fund’s performance as a whole and over time, and is satisfied that the overall return over time has been higher than the return on the fund’s benchmark index, against which the return is measured. In the period from 1998 to 2024, the average annual return before management costs was 0.25 percentage point higher than the return on the benchmark index from the Ministry of Finance.

Norges Bank has reported the contributions to the relative return from the strategies for market exposure, security selection and fund allocation since 2013. The annual return before management costs was also higher than the return on the benchmark index in this period. Market exposure and security selection made positive contributions to the relative return, while fund allocation made a negative contribution.

The objective of the highest possible return is to be achieved with acceptable risk. A variety of risk analyses and calculations are used to obtain a full picture of the fund’s risk exposure, and the Executive Board receives regular analyses of the underlying risk in the management of the fund. The management mandate requires Norges Bank to manage the fund with a view to ensuring that expected relative volatility (tracking error) does not exceed 1.25 percentage points. At the end of 2024, expected relative volatility was 0.44 percentage point, compared with 0.34 percentage point a year earlier. Measured over the full period from 1998 to 2024, realised relative volatility was 0.63 percentage point. The Executive Board is satisfied with the excess return achieved over time given the risk taken in the management of the fund as measured by relative volatility.

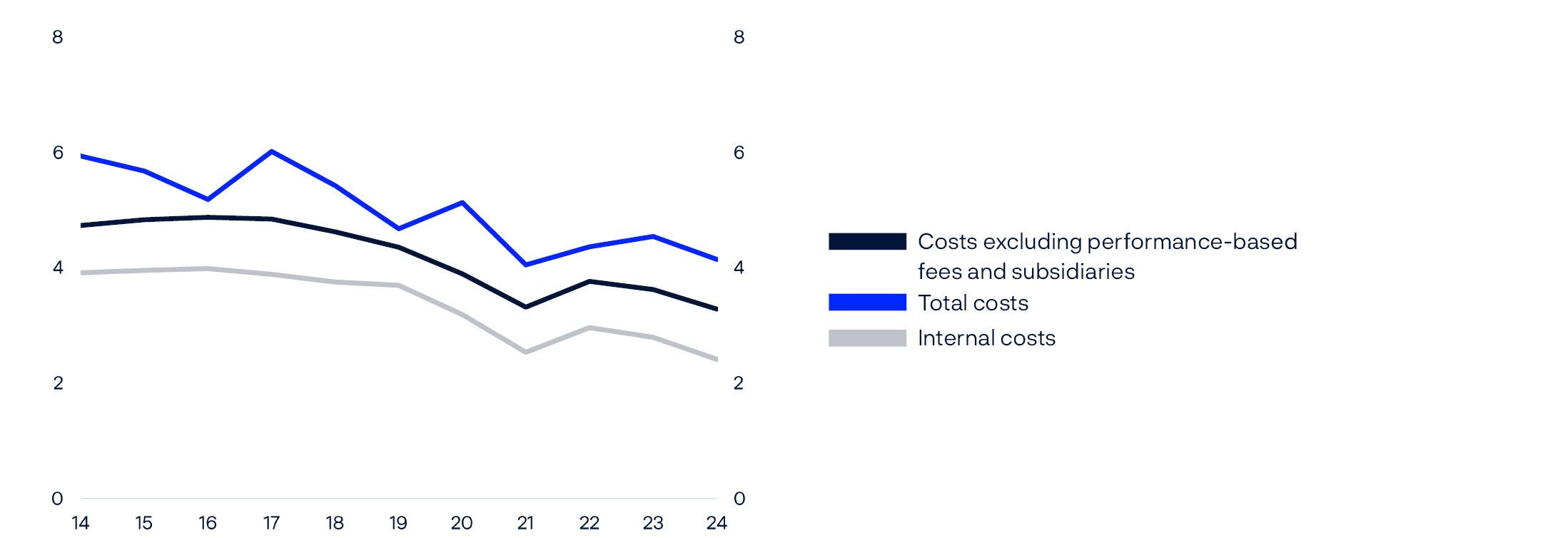

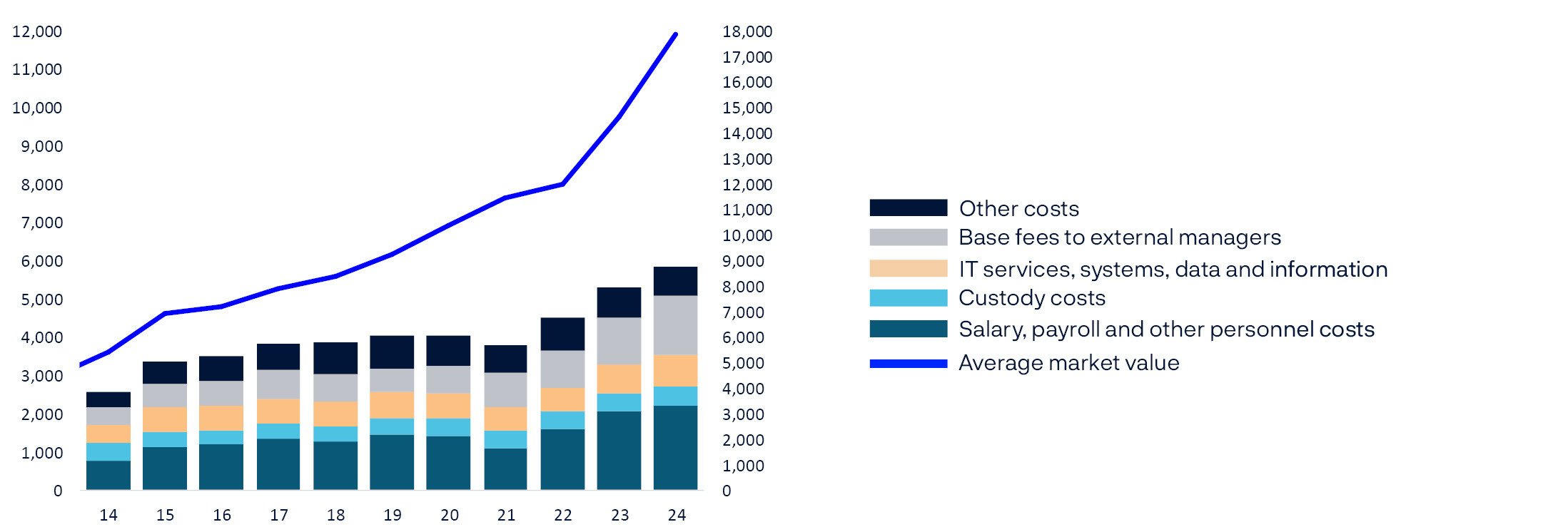

The management of the fund is to be cost-effective. Low costs are not an end in themselves, but cost-effective management helps achieve the objective of the highest possible return after costs. In the period from 2013 to 2024, annual management costs averaged 0.05 percent of assets under management. In 2024, management costs amounted to 7.4 billion kroner, or 0.04 percent of assets under management. The Executive Board is satisfied that management costs are low compared with other managers.

Norges Bank’s Executive Board

Five years of incredible growth

On 6 December 2024, the counter on the Government Pension Fund Global’s homepage ticked past 20 trillion kroner for the first time. It took 23 years for the fund to reach a value of 10 trillion kroner. The next 10 trillion took just five years. The increase in the fund’s value in recent years has been incredible.

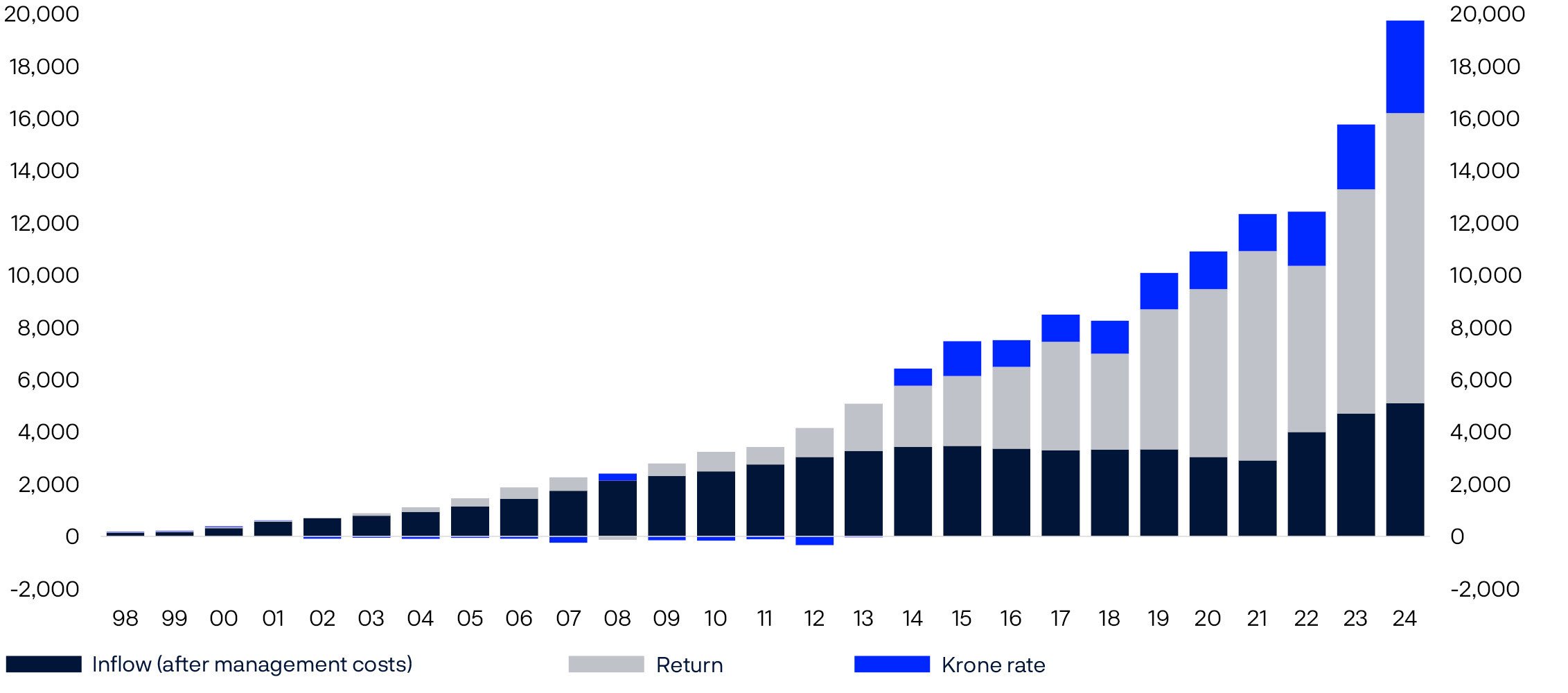

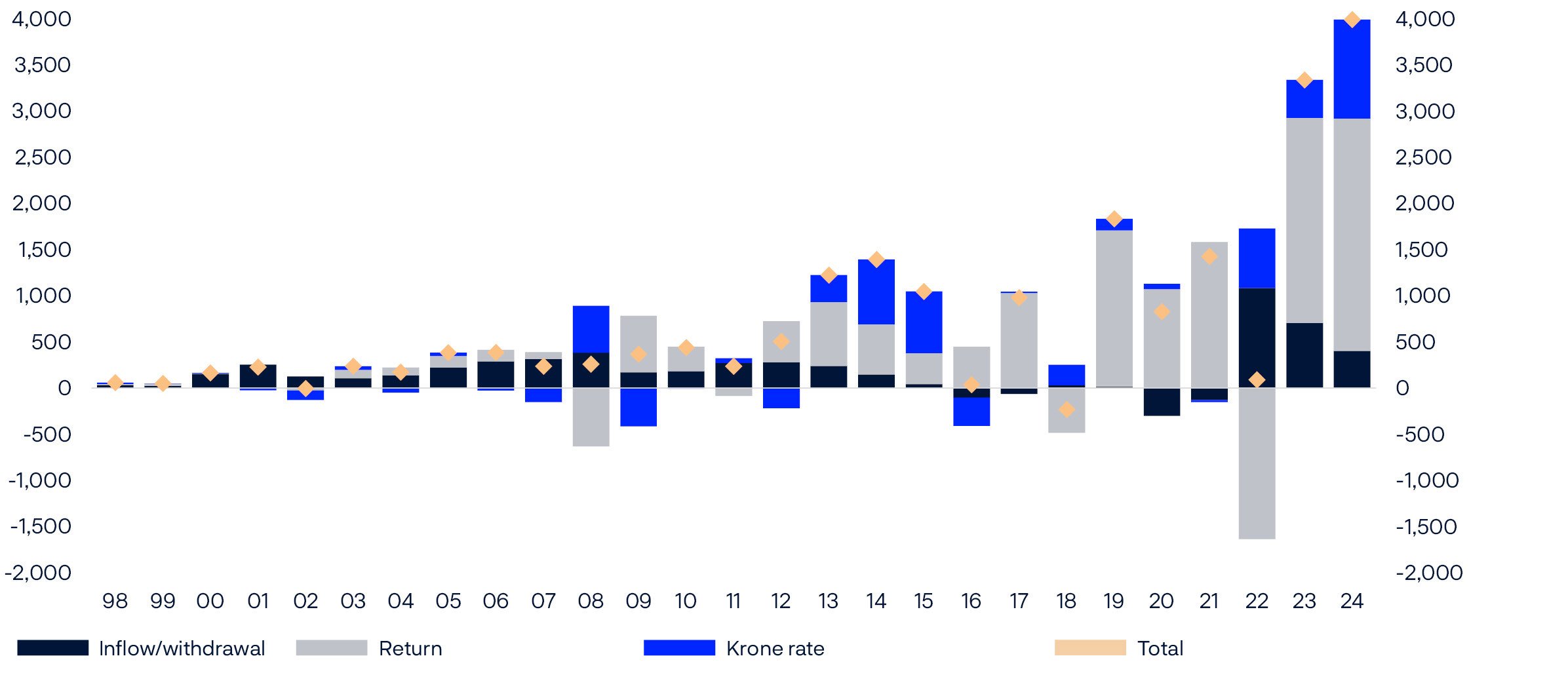

In 2024 alone, the value of the fund increased by 3,985 billion kroner, driven primarily by a strong equity market in general and US tech stocks in particular. A weaker krone also boosted the fund’s value in krone terms, and high oil prices brought strong inflows into the fund.

The Norwegian Parliament has decreed that the fund is to be invested in equities, fixed income, unlisted real estate and unlisted renewable energy infrastructure. The benchmark index used to measure our performance consists of thousands of companies and bonds all around the world. This means that the fund’s risk is spread widely.

Our goal is to beat the benchmark index and generate an excess return in the long term. We did not manage to do so in 2024, due largely to real estate investments, a slightly lower allocation to equities than in the benchmark index, and a reduction in our investments in tech stocks. For a fund with such a long investment horizon, we need to look at periods of more than just a single year, and the excess return since the fund’s inception has been 243 billion kroner.

In absolute terms, the fund returned 13.1 percent in 2024, or a record-high 2,511 billion kroner. Since 1998, the average annual return has been 6.3 percent across both good and bad years – a total of 11,095 billion kroner.

2024 marked half a century since the publication of the first white paper discussing the role of oil in the Norwegian economy. Oil production was then in its infancy, and nobody could have imagined what riches it would bring the country, first from beneath the North Sea and then in global financial markets.

But Norway’s politicians showed in that white paper that they were farsighted. Political control and democratic oversight of oil revenue and financial returns were considered pivotal then and remain so now. Stable and long-term operating conditions are important, enabling us to stand firm in challenging times and exploit opportunities that arise.

It is not easy to be a large financial investor in a turbulent world. We must constantly be willing to change, embrace new technology and learn from everything we do, whatever the markets throw at us.

Oslo, 25 February 2025

Nicolai Tangen

CEO, Norges Bank Investment Management

Strong return on the fund’s investments

The Government Pension Fund Global returned 13.1 percent, or a record-high 2,511 billion kroner, in 2024.

The fund’s value increased by 3,985 billion kroner in 2024, the biggest increase in krone terms in its history. A strong return on the fund’s equity investments was the main reason for this growth. The krone also weakened against many of the currencies the fund is invested in, and there were substantial inflows of capital from the government.

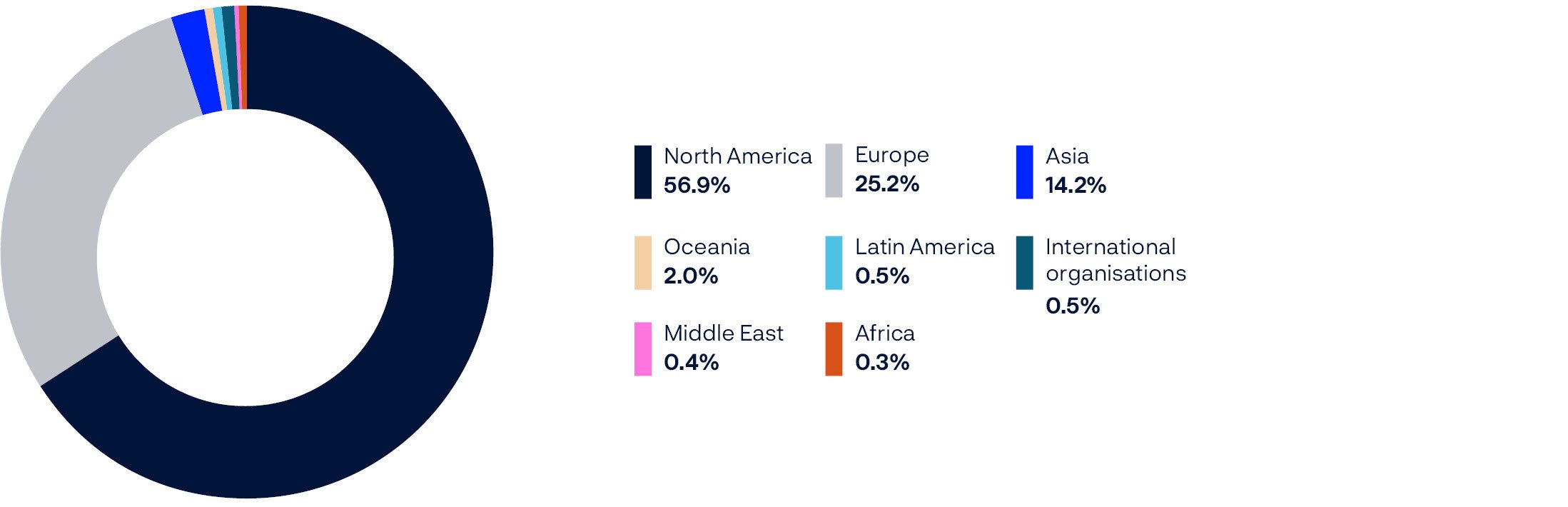

The fund’s investments spanned 70 countries and 42 currencies at the end of the year. Returns are generally measured in international currency – a weighted combination of the currencies in the fund’s benchmark index for equities and bonds. There were 34 currencies in this basket at the end of 2024. Unless otherwise stated, the results in this report are measured in this currency basket.

TABLE 1 Key figures in billions of kroner.

|

2024 |

2023 |

2022 |

2021 |

2020 |

|

|---|---|---|---|---|---|

|

Market value |

|||||

|

Equity investments |

14,113 |

11,174 |

8,677 |

8,884 |

7,948 |

|

Fixed-income investments |

5,253 |

4,272 |

3,412 |

3,135 |

2,695 |

|

Unlisted real estate investments |

364 |

301 |

330 |

312 |

273 |

|

Unlisted infrastructure investments1 |

25 |

18 |

15 |

14 |

|

|

Market value of investment portfolio2 |

19,755 |

15,765 |

12,434 |

12,345 |

10,916 |

|

Deferred tax |

-13 |

-8 |

-4 |

-5 |

-2 |

|

Accrued, not paid, management fees3 |

0 |

0 |

0 |

1 |

-5 |

|

Fund value2 |

19,742 |

15,757 |

12,429 |

12,340 |

10,908 |

|

Inflow of capital |

409 |

711 |

1,090 |

80 |

4 |

|

Withdrawal of capital |

0 |

0 |

0 |

-199 |

-302 |

|

Paid management fees4 |

-7 |

-7 |

-5 |

-10 |

-4 |

|

Return on fund5 |

2,511 |

2,214 |

-1,637 |

1,580 |

1,070 |

|

Changes due to fluctuations in krone6 |

1,072 |

409 |

642 |

-25 |

58 |

|

Changes in accrued, not paid, management fees |

0 |

0 |

0 |

6 |

-1 |

|

Total change in fund value |

3,985 |

3,327 |

89 |

1,432 |

825 |

|

Changes in value since first capital inflow in 1996 |

|||||

|

Total inflow of capital |

5,864 |

5,455 |

4,744 |

3,654 |

3,574 |

|

Total withdrawal of capital3 |

-687 |

-687 |

-687 |

-687 |

-488 |

|

Return on equity investments5 |

9,786 |

7,326 |

5,284 |

6,490 |

4,899 |

|

Return on fixed-income investments5 |

1,252 |

1,192 |

970 |

1,401 |

1,446 |

|

Return on unlisted real estate investments5 |

67 |

71 |

119 |

120 |

84 |

|

Return on unlisted infrastructure investments1, 5 |

2 |

2 |

2 |

1 |

|

|

Management fees4 |

-77 |

-70 |

-63 |

-58 |

-53 |

|

Accumulated fluctuations in krone |

3,547 |

2,475 |

2,065 |

1,423 |

1,448 |

|

Accumulated deferred tax6 |

-12 |

-8 |

-4 |

-5 |

-2 |

|

Fund value |

19,742 |

15,757 |

12,429 |

12,340 |

10,908 |

|

Return on fund |

11,094 |

8,584 |

6,370 |

8,007 |

6,427 |

|

Return after management costs |

11,017 |

8,514 |

6,307 |

7,949 |

6,374 |

1 First unlisted infrastructure investment was made in second quarter of 2021.

2 The market value of the investment portfolio is presented before management fee payable/receivable and deferred tax.

3 Total inflow and withdrawal of capital shown in this table is not adjusted for accrued, not paid, management fees.

4 Management fees are described in note 12 in the financial statements.

5 Fund return of 2,511 billion kroner includes the accounting effect of changes in recognised deferred tax. The return on the investment portfolios excludes deferred tax and amounted to 2,515 billion kroner.

6 Does not include the effect of exchange rate fluctuations on deferred tax.

TABLE 2 The fund's ten largest holdings in percent as at 31 December 2024, by country.

|

Country |

Total |

Equity |

Fixed income |

Unlisted real estate |

Unlisted infrastructure |

|---|---|---|---|---|---|

|

US |

53.4 |

40.0 |

12.5 |

0.86 |

0.00 |

|

Japan |

6.2 |

4.7 |

1.5 |

0.04 |

|

|

UK |

5.5 |

3.7 |

1.4 |

0.33 |

0.04 |

|

Germany |

4.5 |

2.2 |

2.2 |

0.09 |

0.01 |

|

France |

3.4 |

2.1 |

1.0 |

0.26 |

|

|

Canada |

3.1 |

1.4 |

1.7 |

||

|

Switzerland |

2.7 |

2.2 |

0.4 |

0.05 |

|

|

China |

2.2 |

2.2 |

0.0 |

||

|

Netherlands |

2.0 |

1.3 |

0.7 |

0.02 |

0.06 |

|

India |

1.7 |

1.7 |

0.0 |

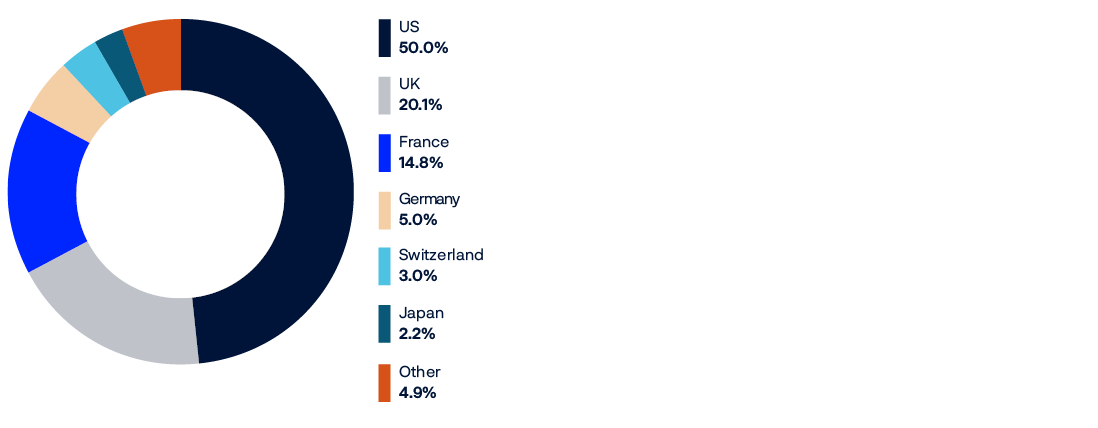

CHART 1 The fund’s investments as at 31 December 2024. Equities, unlisted real estate and infrastructure distributed by country and bonds by currency. In percent.

TABLE 3Return figures in percent.

|

2024 |

2023 |

2022 |

20211 |

2020 |

|

|---|---|---|---|---|---|

|

Returns measured in the fund's currency basket |

|||||

|

Equity investments |

18.19 |

21.25 |

-15.36 |

20.76 |

12.14 |

|

Fixed-income investments |

1.28 |

6.13 |

-12.11 |

-1.93 |

7.46 |

|

Unlisted real estate investments |

-0.57 |

-12.37 |

0.07 |

13.64 |

-0.08 |

|

Unlisted infrastructure investments |

-9.81 |

3.68 |

5.12 |

4.15 |

|

|

Return on fund |

13.09 |

16.14 |

-14.11 |

14.51 |

10.86 |

|

Relative return on fund (percentage points) |

-0.45 |

-0.18 |

0.87 |

0.75 |

0.27 |

|

Management costs |

0.04 |

0.05 |

0.04 |

0.04 |

0.05 |

|

Return on fund after management costs |

13.04 |

16.09 |

-14.15 |

14.47 |

10.81 |

|

Returns in kroner |

|||||

|

Equity investments |

28.10 |

26.26 |

-9.27 |

20.67 |

12.70 |

|

Fixed-income investments |

9.77 |

10.51 |

-5.78 |

-2.01 |

8.00 |

|

Unlisted real estate investments |

7.77 |

-8.75 |

7.27 |

13.55 |

0.42 |

|

Unlisted infrastructure investments |

-2.25 |

7.96 |

12.69 |

7.24 |

|

|

Return on fund |

22.57 |

20.93 |

-7.93 |

14.42 |

11.41 |

1 First unlisted infrastructure investment was made in second quarter of 2021.

TABLE 4 Return on the fund in percent as at 31 December 2024, measured in various currencies.

|

Since 01.01.1998 Annualised figures |

2024 |

2023 |

2022 |

2021 |

2020 |

|

|---|---|---|---|---|---|---|

|

US dollar |

6.28 |

9.60 |

17.30 |

-17.58 |

11.09 |

14.35 |

|

Euro1 |

6.51 |

16.92 |

13.33 |

-12.18 |

19.53 |

4.90 |

|

British pound |

7.38 |

11.56 |

10.68 |

-7.19 |

12.12 |

10.82 |

|

Norwegian krone |

8.02 |

22.57 |

20.93 |

-7.93 |

14.42 |

11.41 |

|

Currency basket |

6.34 |

13.09 |

16.14 |

-14.11 |

14.51 |

10.86 |

1 Euro was introduced as currency on 01.01.1999. WM/Reuters' euro rate is used as estimate for 31.12.1997.

TABLE 5 Historical key figures as at 31 December 2024. Annualised data, measured in the fund's currency basket.

|

Since 01.01.1998 |

Last 15 years |

Last 10 years |

Last 5 years |

Last 12 months |

|

|---|---|---|---|---|---|

|

Fund return (percent) |

6.34 |

7.70 |

7.25 |

7.44 |

13.09 |

|

Annual price inflation (percent) |

2.12 |

2.35 |

2.61 |

3.69 |

2.67 |

|

Annual management costs (percent) |

0.08 |

0.06 |

0.05 |

0.04 |

0.04 |

|

Net real return on fund (percent) |

4.06 |

5.17 |

4.47 |

3.57 |

10.10 |

|

The fund's actual standard deviation (percent) |

8.39 |

8.95 |

9.72 |

11.85 |

6.28 |

|

Relative return on fund (percentage points)1 |

0.25 |

0.26 |

0.26 |

0.29 |

-0.45 |

|

The fund's tracking error (percentage points)1 |

0.63 |

0.39 |

0.39 |

0.45 |

0.21 |

|

The fund's information ratio (IR)1,2 |

0.41 |

0.61 |

0.61 |

0.57 |

-1.90 |

1 Based on aggregated equity and fixed-income investments until end of 2016.

2 The fund's information ratio (IR) is the ratio of the fund's average monthly relative return to the fund's tracking error. The IR indicates how much relative return has been achieved per unit of relative risk.

CHART 3 Historical returns on the fund's investments in percent, by asset class.

CHART 4 The fund’s market value in billions of kroner, by asset class.

CHART 5 The fund’s market value in billions of kroner.

CHART 6 Changes in the fund’s market value in billions of kroner.

Strong year for equity investments

The fund’s equity investments returned 18.2 percent in 2024, continuing their positive performance from 2023. Solid corporate earnings and a brighter growth outlook, along with falling policy rates and lower inflation expectations, led to strong equity markets.

US technology stocks contributed most to the positive return, driven mainly by the largest technology companies.

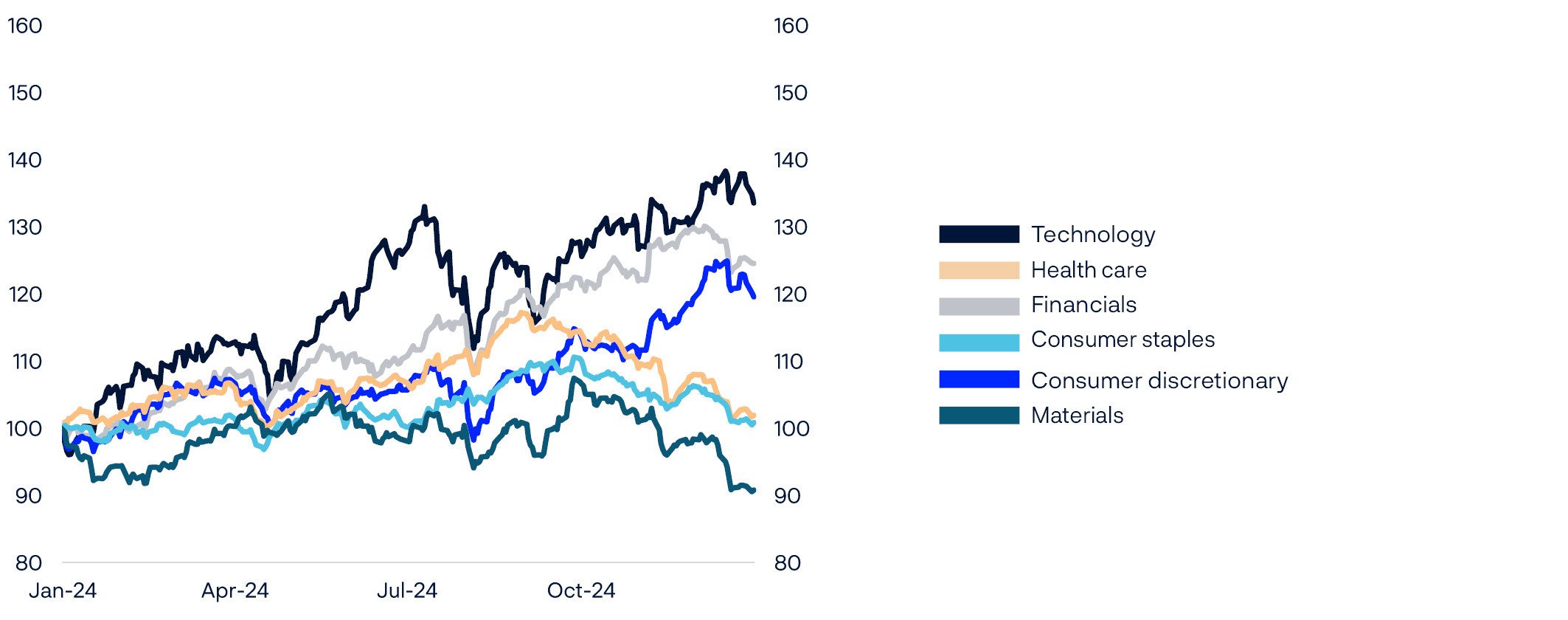

Tech stocks perform best

Technology stocks were the best performers in 2024 with a return of 35.1 percent. This strong return was due to strong demand for advertising and chat solutions based on AI from the leading internet and software companies and their semiconductor suppliers.

Financials were the next-strongest sector with a return of 27.8 percent. A strong economic climate, high but falling interest rates, and the outcome of the US election led to increased optimism about growth in lending and capital markets, and credit quality was stable.

Consumer discretionary was the third-best performer, returning 19.3 percent. Despite a challenging market, the value of the leading companies in the sector continued to grow as a result of increased market share and earnings, to levels higher than before the Covid-19 pandemic.

Basic materials produced the weakest return of -7.3 percent. Results were hit by high interest rates, flat demand in the US and a reduced need for materials in Europe and China. Regulatory uncertainty and weak interest in electric cars outside China also had a negative effect.

Individual investments

The fund was invested in 8,659 companies at the end of 2024, compared with 8,859 a year earlier. The decrease was mainly due to ongoing portfolio adjustments made by our internal and external managers.

The investments in technology companies NVIDIA Corp, Apple Inc and Amazon.com Inc made the most positive contributions to the return for the year. The worst-performing investments were in telecommunications company Samsung Electronics, consumer goods company Nestlé SA and technology company Intel Corp.

The fund participated in 112 initial public offerings during the year. The largest of these were at Midea Group Co LTD, SF Holdings Co and Hyundai Motor Ltd India. The offerings in which the fund invested the most were at Lineage Inc, Puig Brands SA-B and Viking Holdings LTD.

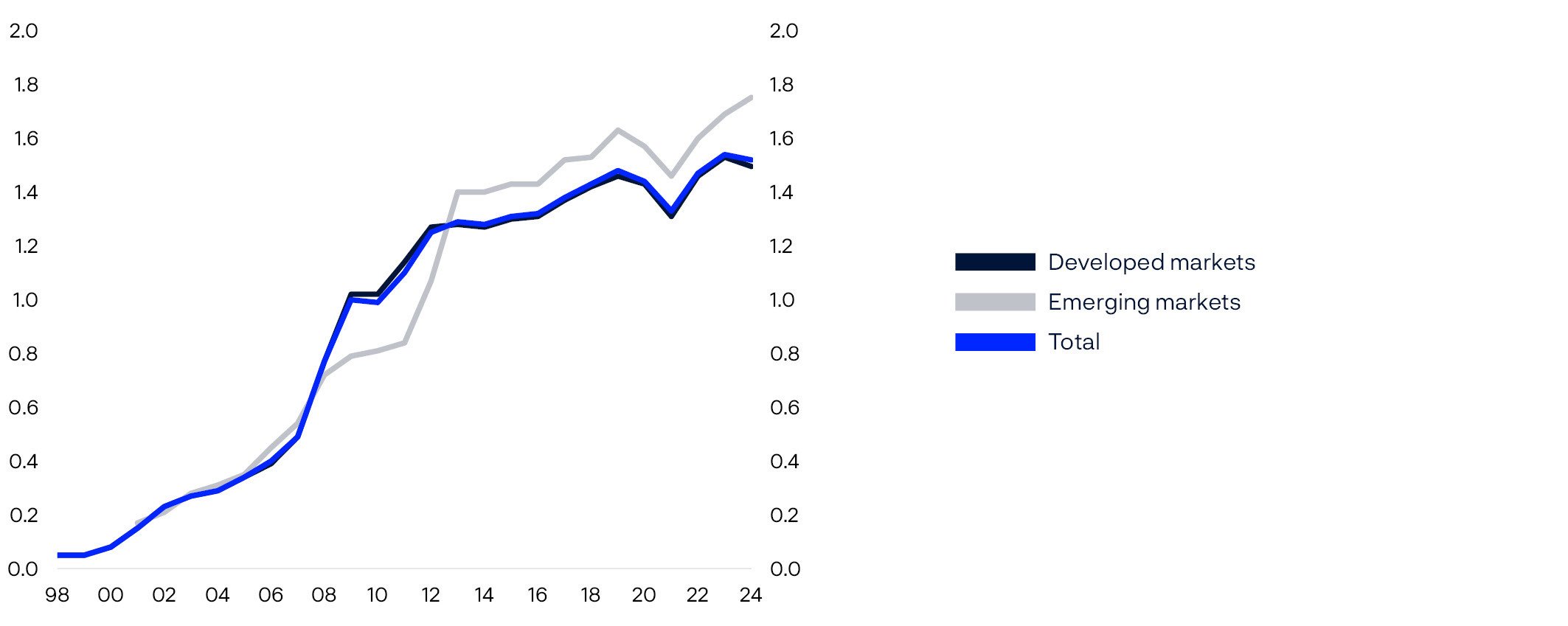

At the end of the year, the fund had holdings of more than 2 percent in 1,199 companies, and more than 5 percent in 69 companies. Its average holding in the world’s listed companies was 1.5 percent.

Excluding unlisted real estate companies, the largest percentage holding in any one company was in Croda International PLC. The fund’s 9.5 percent stake was worth 6.4 billion kroner. With the exception of listed real estate companies, the fund may hold no more than 10 percent of the voting shares in a company.

A full list of the fund’s equity investments can be found at www.nbim.no.

TABLE 6 Return on the fund's largest equity investments in 2024 by country. In percent.

|

Country |

Return in international currency |

Return in local currency |

Share of equity investments1 |

|---|---|---|---|

|

US |

27.4 |

23.5 |

57.9 |

|

Japan |

11.4 |

20.3 |

6.8 |

|

UK |

10.3 |

8.8 |

5.4 |

|

China |

20.3 |

20.0 |

3.3 |

|

Switzerland |

0.6 |

5.0 |

3.2 |

|

Germany |

14.8 |

18.7 |

3.2 |

|

France |

-3.7 |

-0.4 |

3.1 |

|

India |

20.1 |

19.8 |

2.5 |

|

Taiwan |

36.1 |

40.9 |

2.5 |

|

Canada |

17.8 |

24.6 |

2.0 |

1 Does not sum up to 100 percent because cash and derivatives are not included.

TABLE 7 Return on the fund's equity investments in 2024. Measured in international currency and sorted by sector. In percent.

|

Sector |

Return |

Share of equity investments1 |

|---|---|---|

|

Technology |

35.1 |

27.9 |

|

Financials |

27.8 |

15.9 |

|

Consumer discretionary |

19.3 |

14.8 |

|

Industrials |

16.2 |

13.1 |

|

Health care |

5.1 |

10.2 |

|

Real estate |

7.3 |

5.1 |

|

Consumer staples |

-0.2 |

4.8 |

|

Energy |

3.8 |

3.3 |

|

Basic materials |

-7.3 |

3.2 |

|

Telecommunications |

7.6 |

3.0 |

|

Utilities |

10.9 |

2.4 |

1 Does not sum up to 100 percent because cash and derivatives are not included.

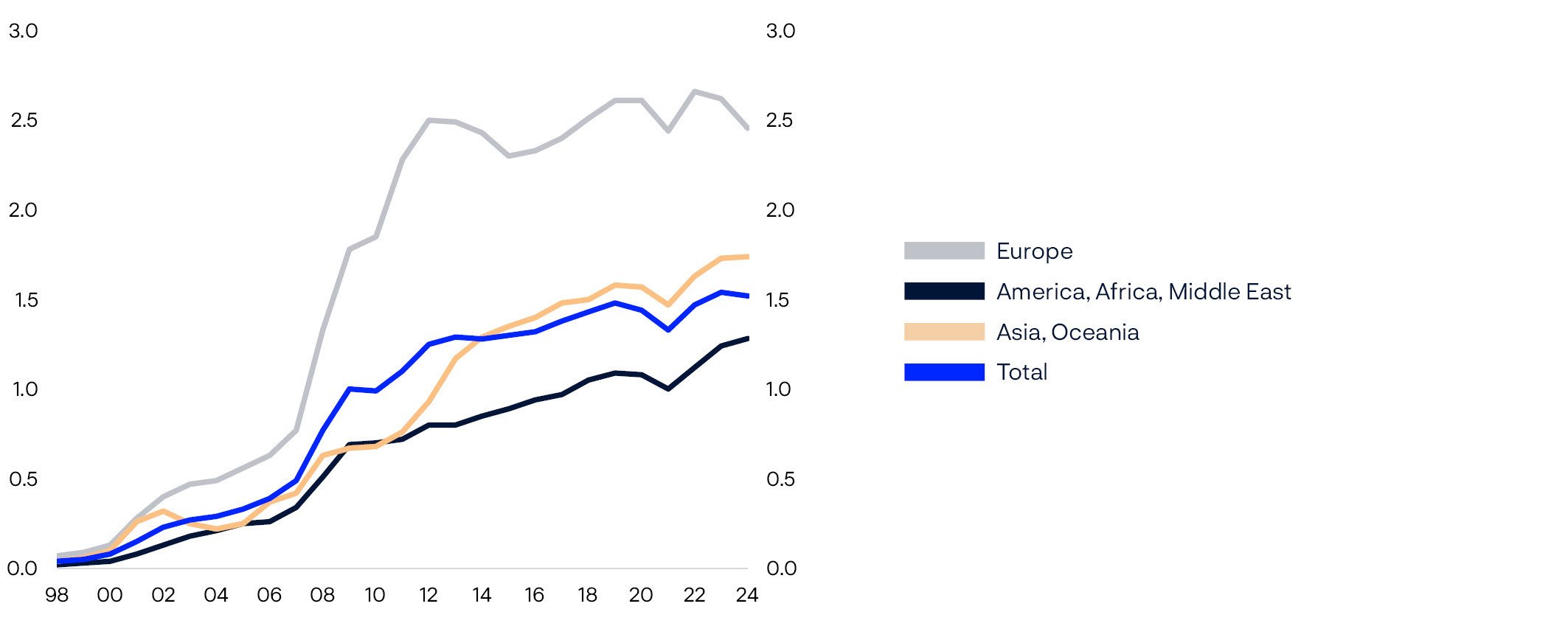

CHART 7 The fund’s holdings in equity markets. Percentage of market value of equities in the benchmark index.

Source: FTSE Russell, Norges Bank Investment Management

CHART 8 The fund’s holdings in equity markets. Percentage of market value of equities in the benchmark index.

Source: FTSE Russell, Norges Bank Investment Management

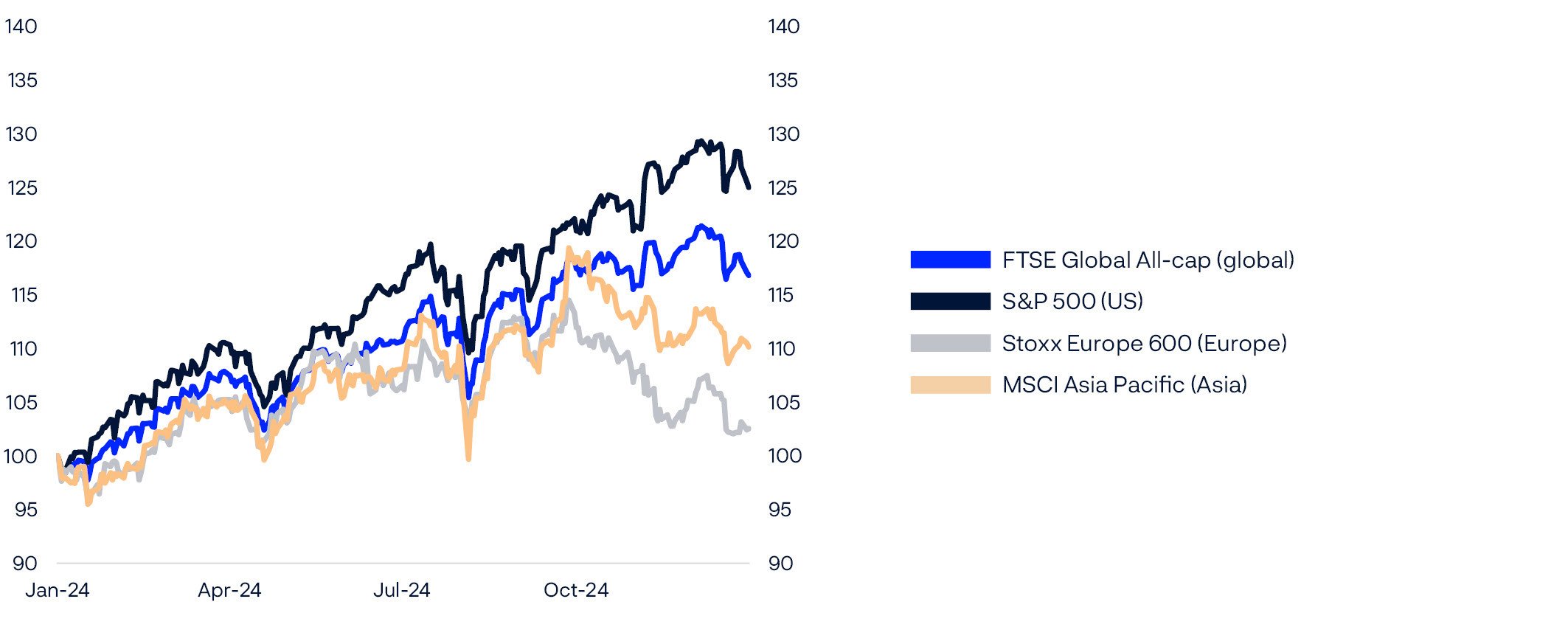

CHART 9 Return on regional equity markets. Measured in dollars. Indexed total return 31.12.2023 = 100.

Source: Bloomberg

CHART 10 The three sectors with the highest and weakest return in the FTSE Global All Cap index. Measured in dollars. Indexed total return 31.12.2023 = 100.

Source: FTSE Russell

Slight positive return on fixed income

The fund’s fixed-income investments returned 1.3 percent in 2024. Yields increased over the year as a whole, meaning that the return was below the portfolio’s average lending rate.

Long yields increased during the first four months of the year. Inflation came out higher than anticipated, and market expectations of rate cuts during the year faded. Towards summer, however, it became clear that the economies of North America and Europe had cooled sufficiently. The European Central Bank began to lower its policy rate in June, while the Federal Reserve waited until September.

Strongest return on corporate bonds

Government bonds returned -0.1 percent in 2024 and made up 60.2 percent of the fund’s fixed-income investments at the end of the year.

US Treasuries returned 3.4 percent and accounted for 31.0 percent of fixed-income investments. The Federal Reserve lowered its policy rate by a total of 1 percentage point during the year.

Euro-denominated government bonds returned -2.1 percent and amounted to 12.3 percent of fixed-income investments. The European Central Bank also cut its policy rate by a total of 1 percentage point during the year. The lower return compared to the US was due to the euro weakening.

Japanese government bonds returned -10.5 percent and made up 5.1 percent of the fund’s fixed-income holdings. Japan went against the flow and tightened monetary policy in 2024. The yen fell sharply until summer, with the authorities twice intervening to stabilise the currency.

TABLE 8 Return on the fund's largest bond holdings by currency in 2024. In percent.

|

Currency |

Return in international currency |

Return in local currency |

Share of fixed-income investments |

|---|---|---|---|

|

US dollar |

4.6 |

1.4 |

52.4 |

|

Euro |

-0.7 |

2.7 |

27.6 |

|

Japanese yen |

-10.2 |

-3.0 |

5.3 |

|

Canadian dollar |

-1.3 |

4.3 |

5.3 |

|

British pounds |

-2.2 |

-3.5 |

4.6 |

|

Singapore dollar |

3.4 |

3.7 |

4.2 |

|

Australian dollar |

-3.9 |

2.6 |

2.2 |

|

Swiss franc |

1.1 |

5.5 |

0.8 |

|

Swedish krona |

-3.4 |

2.6 |

0.6 |

|

New Zealand dollar |

-4.5 |

4.6 |

0.5 |

Corporate bonds returned 4.8 percent and made up 24.8 percent of the fund’s fixed-income investments at the end of the year. The return was boosted by a high allocation to dollar bonds and a lower credit premium (the compensation investors demand for holding bonds of this type rather than safer alternatives).

A full list of the fund’s fixed-income investments can be found at www.nbim.no.

TABLE 9 Return on the fund's fixed-income investments in 2024. Measured in international currency and sorted by sector. In percent.

|

Sector |

Return |

Share of fixed-income investments1 |

|---|---|---|

|

Government bonds2 |

-0.1 |

60.2 |

|

Government-related bonds2 |

-0.3 |

9.4 |

|

Inflation-linked bonds2 |

-0.1 |

5.8 |

|

Corporate bonds |

4.8 |

24.8 |

|

Securitised bonds |

0.9 |

5.8 |

1 Does not sum up to 100 percent because cash and derivatives are not included.

2 Governments may issue different types of bonds, and the fund’s investments in these bonds are grouped accordingly. Bonds issued by a country’s government in the country’s own currency are categorised as government bonds. Bonds issued by a country’s government in another country’s currency are government-related bonds. Inflation-linked bonds issued by governments are grouped with inflation-linked bonds.

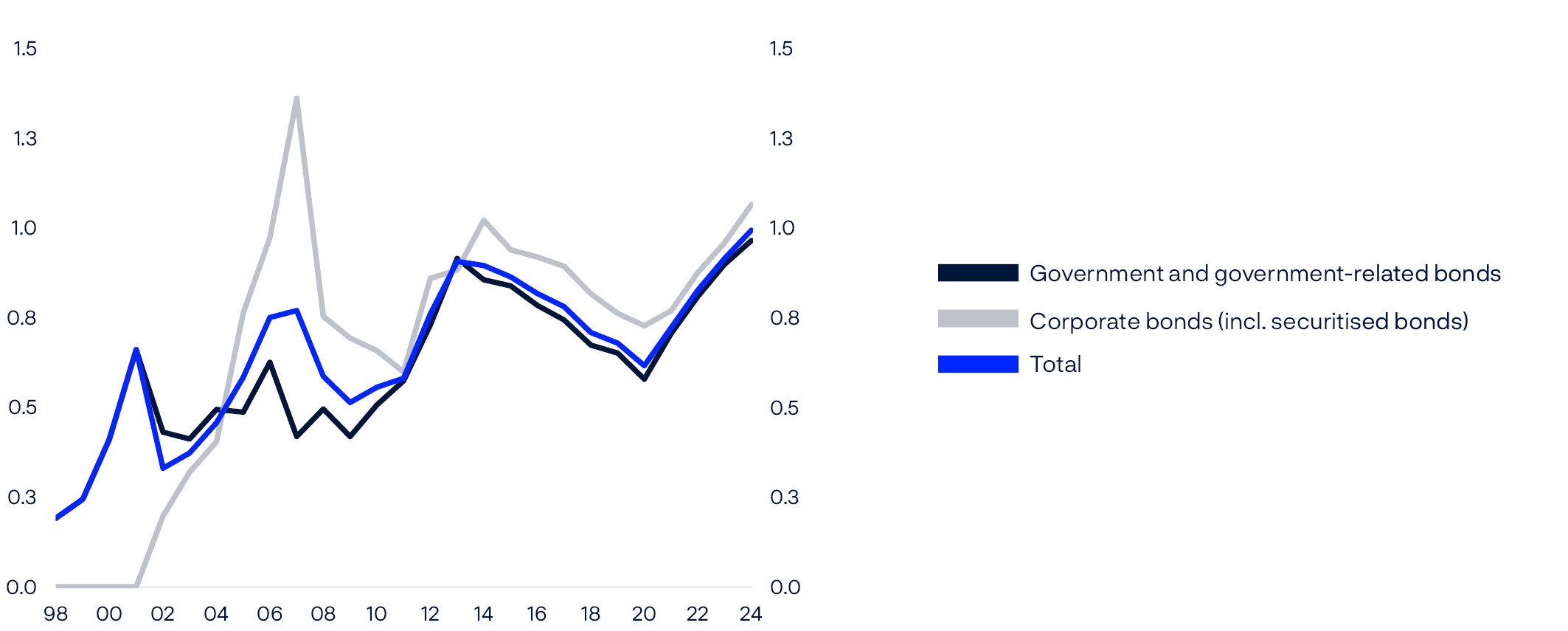

CHART 11 The fund’s holdings in fixed-income markets. Percentage of market value of bonds in the benchmark index.

Source: Bloomberg Barclays Indices, Norges Bank Investment Management

CHART 12 Return on bonds issued in various currencies. Measured in local currencies. Indexed total return 31.12.2023 = 100.

Source: Bloomberg Barclays Indices, Norges Bank Investment Management

CHART 13 Return in fixed-income sectors. Measured in dollars. Indexed total return 31.12.2023 =100.

Source: Bloomberg Barclays Indices, Norges Bank Investment Management

CHART 14 10-year government bond yields in percent.

Source: Bloomberg Barclays Indices, Norges Bank Investment ManagementBloomberg

Positive return on real estate investments

The fund’s investments in real estate returned 4.8 percent in 2024 and made up 3.7 percent of the fund at the end of the year. Unlisted real estate investments returned -0.6 percent, and listed real estate investments 9.9 percent.

The fund’s real estate strategy covers both unlisted and listed real estate investments. Altogether, these investments amounted to 722 billion kroner at the end of the year.

TABLE 10 Value of real estate investments in millions of kroner as at 31 December 2024.

|

Value1 |

|

|---|---|

|

Unlisted real estate investments |

363,583 |

|

Listed real estate investments |

358,524 |

|

Aggregated real estate investments |

722,107 |

1 Including bank deposits and other receivables

Unlisted real estate

The fund’s investments in unlisted real estate had a market value of 364 billion kroner at the end of the year, equivalent to 1.8 percent of the fund and 50.4 percent of our total real estate investments.

The fund’s unlisted real estate investments are primarily in office, retail and logistics properties. Office properties account for around half of the portfolio, and investments in office and retail premises are concentrated in a limited number of major cities.

The management mandate from the Ministry of Finance to Norges Bank sets an upper limit for unlisted real estate investments of 7 percent of the fund’s value. The fund has a long-term investment strategy and limited borrowing needs, which means that we can also invest selectively when market corrections create attractive opportunities.

Real estate markets stabilised somewhat in 2024 after several turbulent years. Transaction activity was still low but increased in most markets.

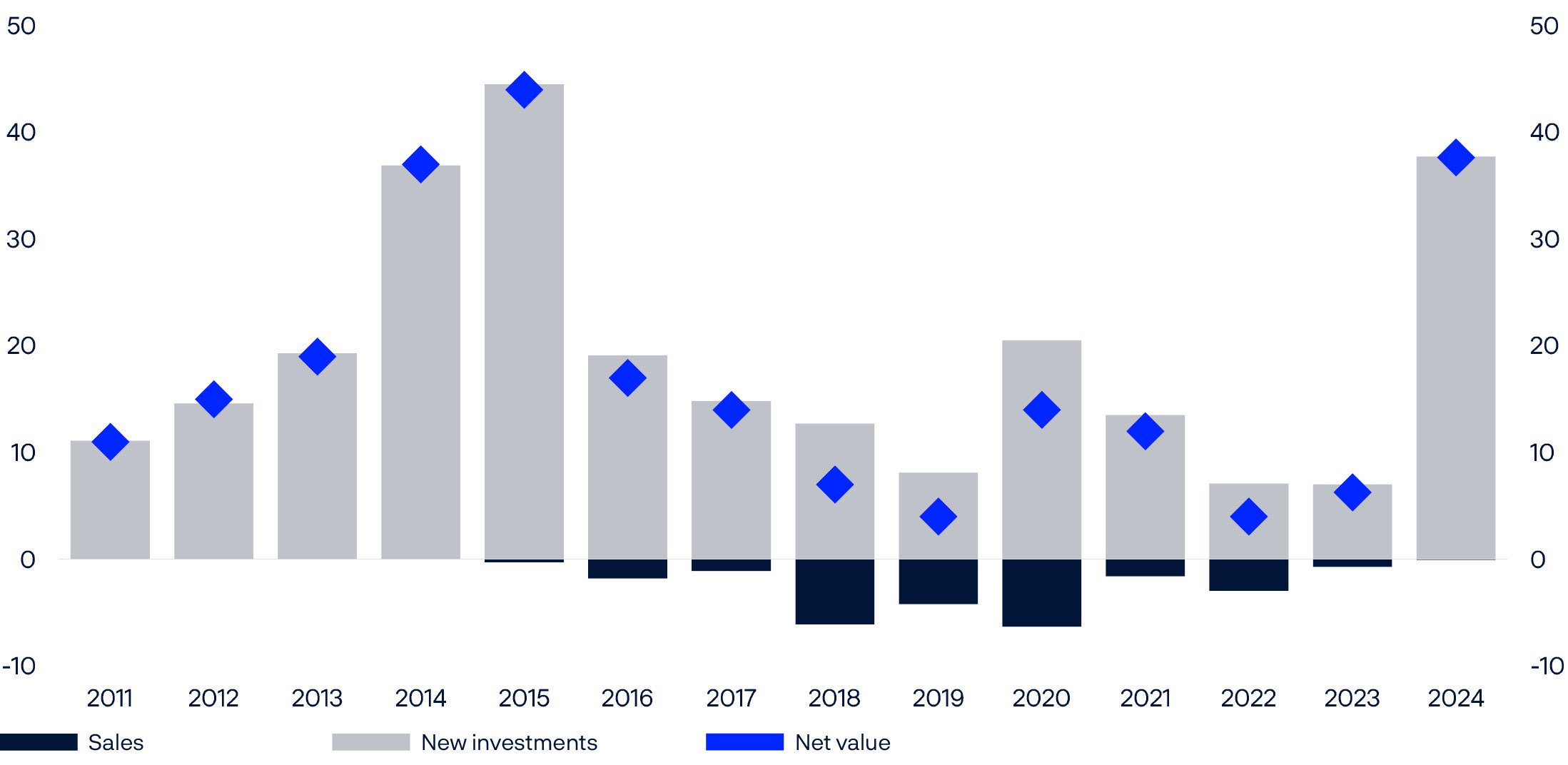

We capitalised on the uncertainty and lack of liquidity in the market to make a number of purchases. Purchase volumes have generally been low since 2015 but increased considerably in 2024. Several ongoing transactions will be completed in the first quarter of 2025.

TABLE 11 Return on the fund's unlisted real estate investments in percentage points.

|

Since 01.04.2011 |

2024 |

2023 |

2022 |

2021 |

2020 |

|

|---|---|---|---|---|---|---|

|

Rental income |

3.7 |

3.9 |

3.4 |

3.1 |

3.4 |

3.4 |

|

Change in value |

0.8 |

-4.8 |

-16.2 |

-3.0 |

9.8 |

-3.5 |

|

Transaction costs |

-0.7 |

-0.1 |

-0.1 |

-0.1 |

-0.1 |

-0.2 |

|

Currency effect |

0.2 |

0.6 |

1.1 |

0.1 |

0.2 |

0.3 |

|

Total (percent) |

4.0 |

-0.6 |

-12.4 |

0.1 |

13.6 |

-0.1 |

TABLE 12 The fund's largest unlisted real estate investments as at 31 December 2024.

|

Retail, office and other by city1 |

Percent |

|---|---|

|

Paris |

13.4 |

|

London |

12.4 |

|

Boston |

9.0 |

|

New York |

7.4 |

|

Washington, D.C. |

4.0 |

|

Berlin |

3.9 |

|

San Francisco |

3.7 |

|

Zurich |

2.9 |

|

Tokyo |

2.2 |

|

Sheffield |

1.6 |

|

Cambridge |

0.3 |

|

Logistics by country |

Prosent |

|---|---|

|

US |

25.0 |

|

UK |

4.4 |

|

France |

1.4 |

|

Germany |

1.1 |

|

Netherlands |

1.1 |

|

Spain |

1.0 |

|

Italy |

1.0 |

|

Czech Republic |

0.7 |

|

Other countries |

1.1 |

1 Excluding investments in logistics

TABLE 13 Return on the fund's unlisted real estate investment by market as at 31 December 2024. In percent.

|

Market |

Return |

Share of portfolio |

|---|---|---|

|

Europe |

3.8 |

47.8 |

|

US |

-5.9 |

50.0 |

|

Japan |

2.5 |

2.2 |

CHART 15 The fund’s unlisted real estate investments by sector as at 31 December 2024.

1 Other sectors, bank deposits and other claims.

CHART 16 The fund’s unlisted real estate investments by country as at 31 December 2024.

CHART 17 Annual investments in unlisted real estate. Completed transactions in billions of kroner.

Listed real estate

Investments in listed real estate made up 1.8 percent of the fund and 49.6 percent of our total real estate investments at the end of the year.

These investments were spread across 53 listed companies. The largest percentage stakes were 25.2 percent of Shaftesbury Capital PLC and 14.7 percent of Vonovia SE. The single largest investment was in Welltower Inc at 44.6 billion kroner.

A full list of the fund’s real estate investments can be found at www.nbim.no.

TABLE 14 Owenship shares in percent for the 10 largest listed investments in real estate management as at 31. desember 2024.

|

Company |

Country |

Ownership share1 |

|---|---|---|

|

Shaftesbury Capital PLC |

UK |

25.2 |

|

Vonovia SE |

Germany |

14.7 |

|

Great Portland Estates PLC |

UK |

9.4 |

|

Alexandria Real Estate Equities Inc |

US |

9.4 |

|

Gecina SA |

France |

9.3 |

|

Equity Residential |

US |

9.1 |

|

Grainger PLC |

UK |

9.1 |

|

Regency Centers Corp |

US |

9.1 |

|

Vornado Realty Trust |

US |

9.1 |

|

UNITE Group PLC/The |

UK |

8.9 |

1 The ownership shares also include holdings that are a part of the equity management.

TABLE 15 The fund's largest listed investments in real estate management. In millions of kroner as at 31 December 2024.

|

Company |

Country |

Holding1 |

|---|---|---|

|

Welltower Inc |

US |

44,611 |

|

Digital Realty Trust Inc |

US |

43,769 |

|

Vonovia SE |

Germany |

41,751 |

|

Equity Residential |

US |

28,255 |

|

Simon Property Group Inc |

US |

23,260 |

|

Invitation Homes Inc |

US |

18,657 |

|

Alexandria Real Estate Equities Inc |

US |

18,194 |

|

AvalonBay Communities Inc |

US |

16,952 |

|

UDR Inc |

US |

14,430 |

|

Regency Centers Corp |

US |

14,307 |

1 The holdings also include holdings that are part of the equity management.

Unlisted renewable energy infrastructure

Investments in unlisted renewable energy infrastructure returned -9.8 percent and made up 0.1 percent of the fund at the end of the year.

The return on investments in renewable energy infrastructure comprises the net income from these assets and the change in their value during the period. Expected future power prices, expected future production volumes and the estimated cost of capital impact valuations. The value of the assets also falls over time as their expected remaining life decreases. The negative return in 2024 was due primarily to a higher cost of capital.

The fund made four new investments in unlisted renewable energy infrastructure during the year. In January, we signed an agreement to acquire a 49 percent interest in a portfolio of solar and onshore wind assets in Spain and Portugal for 307 million euros, or around 3.5 billion kroner. In April, we agreed to acquire a 49 percent stake in two solar projects in Spain for 203 million euros, or around 2.4 billion kroner. Also in April, we signed an agreement to acquire 37.5 percent of Race Bank, an operational offshore wind project in the UK, for 330 million pounds, or around 4.5 billion kroner. Our share of the project includes a debt facility of around 644 million pounds, or around 8.8 billion kroner.

In August, we signed an agreement to invest 900 million euros, or around 10.6 billion kroner, in Copenhagen Infrastructure V (CI V), the fifth flagship fund from Copenhagen Infrastructure Partners (CIP). CIP and CI V will invest in renewable energy with a focus on offshore wind, onshore wind, solar, power networks and storage. Investments will be spread evenly across three regions: North America, Western Europe and developed markets in Asia Pacific.

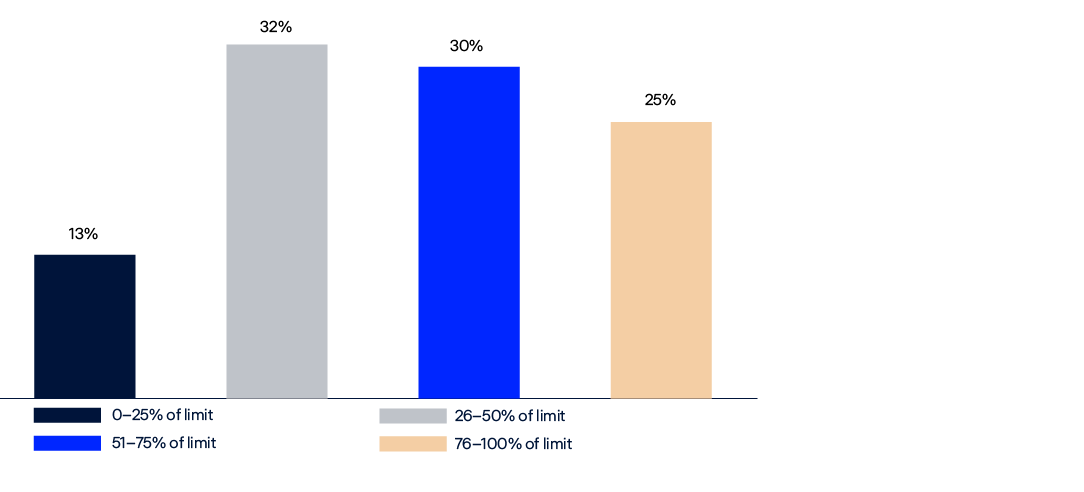

The management mandate from the Ministry of Finance sets an upper limit for investments in unlisted renewable energy infrastructure of 2 percent of the fund’s value.

A full list of the fund’s unlisted renewable energy infrastructure investments can be found at www.nbim.no.

TABLE 16Value of unlisted infrastructure investments in millions of kroner as at 31 December 2024.

|

Value1 |

|

|---|---|

|

Unlisted infrastructure investments |

25,348 |

1 Including bank deposits and other receivables.

TABLE 17 Return of unlisted infrastructure investments in percent as at 31 December 2024.

|

Return |

|

|---|---|

|

Unlisted infrastructure investments |

-9.81 |

Investment risk

With a large, global fund and a 70 percent allocation to equities, we have to be prepared for considerable fluctuations in the fund’s return and market value.

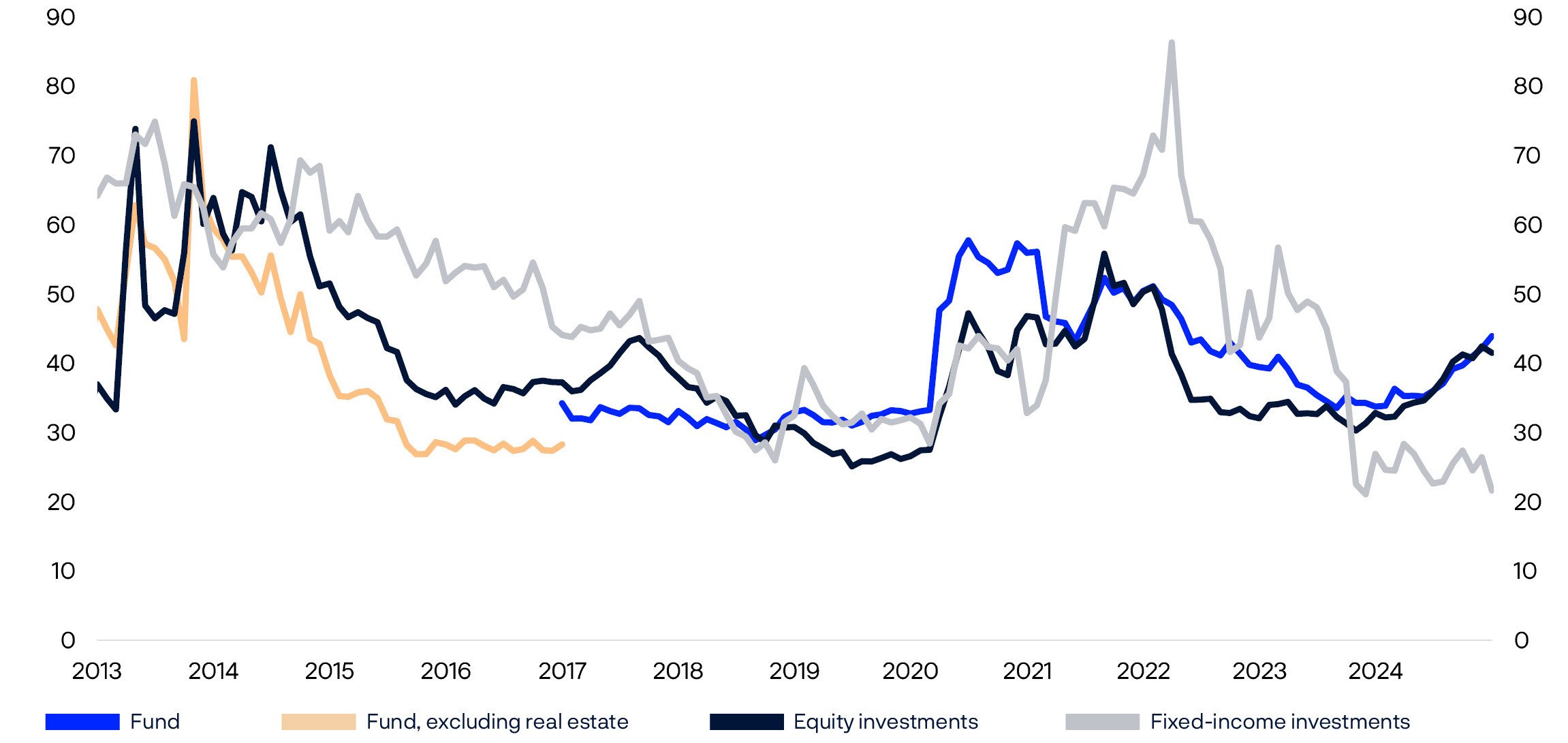

Risk management and volatility

The risk in the fund is driven largely by how much of it is invested in equities and how much equity prices fluctuate. Movements in interest rates, credit risk premiums and exchange rates will also affect risk, as will changes in the value of investments in real estate and unlisted renewable energy infrastructure. As an investor, we need to have good systems for analysing and managing this risk.

Measuring the fund’s risk exposure is a challenge. To obtain a full picture, we use a variety of risk analyses and calculations. We monitor the fund’s concentration risk, expected fluctuations in markets and fund value, factor exposures and liquidity risk. We also perform stress tests and hypothetical scenario analyses on the portfolio. Some investment strategies can expose the fund to an increased risk of rare but large and unpredictable losses, and so we closely monitor exposure to strategies of this type.

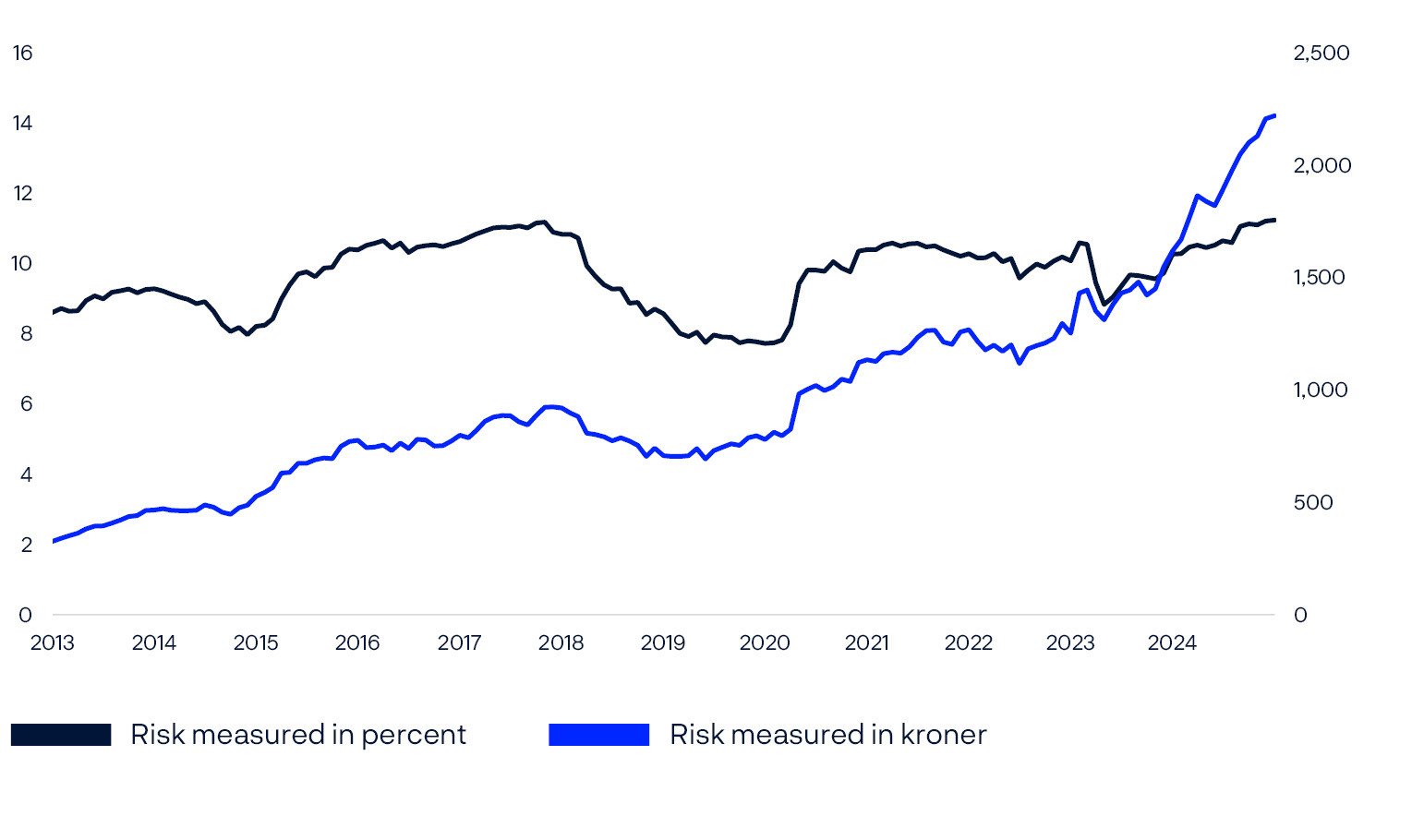

Expected absolute volatility is a measure of how much the annual return on the fund’s investments can normally be expected to fluctuate. This is calculated using standard deviation based on a three-year price history. The fund’s expected absolute volatility was 11.2 percent at the end of 2024, or about 2,200 billion kroner, meaning that the value of the fund can be expected to fluctuate by more than that amount in one out of every three years.

CHART 18 Expected absolute volatility for the fund. Percent (left-hand axis) and billions of kroner (right-hand axis).

Scenario analyses

Each year, we publish the results of analyses of a number of hypothetical scenarios. These scenarios may change from year to year to reflect market developments and events that impact economic performance. This year, we look at whether a combination of high equity valuations, high debt levels and increased geopolitical tensions could result in substantial reductions in the fund’s value over time.

This year’s scenarios build on last year’s analyses, where we considered how repricing of risk, a debt crisis and a fragmented world might impact negatively on the fund’s value. The AI correction scenario can be seen as a continuation of last year’s risk-repricing scenario and places particular emphasis on the concentration of AI stocks in the market. This year’s debt-crisis scenario is more wide-ranging than last year’s and looks at a broad loss of confidence among investors, while the fragmented-world scenario has been expanded from focusing on two economic blocs with geopolitical tensions to cover multiple regions.

AI correction

A significant correction in the technology sector is triggered by investments in AI failing to generate the expected earnings and value creation. This might be due to stricter regulation, technological challenges or a lack of necessary resources. This correction has a particular impact on the US technology sector but also spreads to other sectors and regions.

Debt crisis

High global debt levels combined with an ageing population, climate change and international conflicts trigger a bond crisis. Decreased confidence in the market leads to a substantial increase in yields and risk premiums, which in turn have adverse effects on both equity and bond markets.

Fragmented world

The world fragments into multiple economic blocs with reduced levels of co-operation. This leads to increased trade barriers, stricter regulation and reduced foreign investment. Developing countries are hit particularly hard. Decreased economic co-operation leads to lower global growth, higher inflation and increased market volatility.

We have analysed how these scenarios might impact the fund’s value, calculating potential losses over a period of up to five years. Losses on equities are considerable in all of the scenarios, but the effect on the fixed-income market varies. The debt-crisis scenario produces the heaviest losses, with the fund’s value falling by 40 percent.

A full report on this stress testing can be found at www.nbim.no.

CHART 19 Estimated market value of the the fund under each scenario and potential losses in percent.

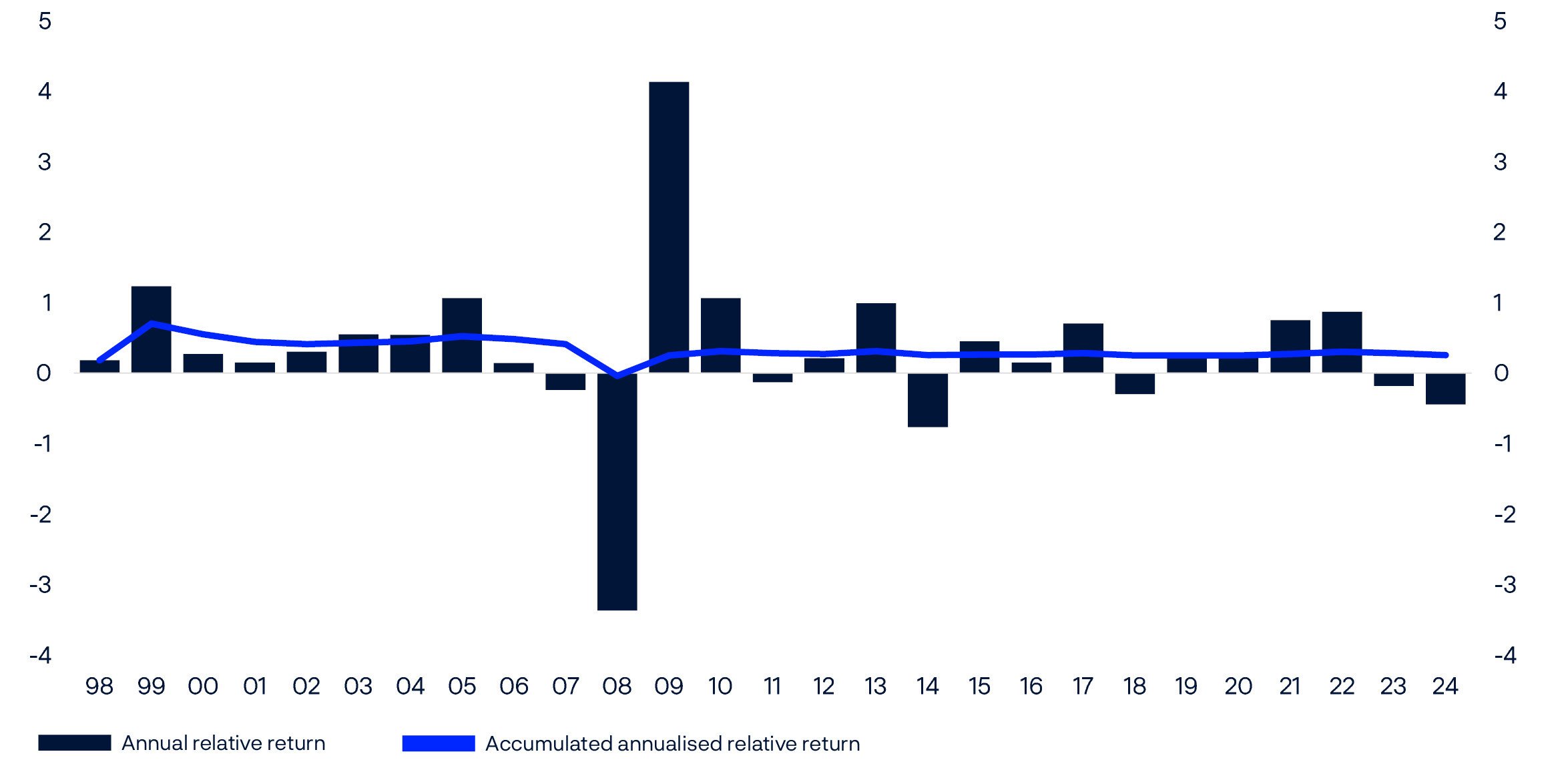

The fund’s relative return

We aim to leverage the fund’s long-term investment horizon and considerable size to generate a high return with acceptable risk. In 2024, the fund’s return was 0.45 percentage point lower than the return on the benchmark index.

The return on the fund’s investments is measured against the return on the fund’s benchmark index from the Ministry of Finance, which is made up of global equity and bond indices. The equity portion of the benchmark index is based on the FTSE Global All Cap index and comprised 8,716 listed companies at the end of the year. The bond portion of the benchmark index is based on indices from Bloomberg Indices and consisted of 18,354 bonds from 2,456 issuers.

At the end of 2024, the fund was invested in 8,659 listed companies and 6,934 bonds from 1,507 issuers. The fund also had investments in 910 unlisted properties and 7 investments in unlisted renewable energy infrastructure. To achieve our objective of the highest possible return after costs, we delegate the responsibility for individual investments to our portfolio managers through individual investment mandates. These mandates are awarded within the fund’s three main strategies: market exposure, security selection and fund allocation. This gives us deep insight into selected market segments and companies, and makes us a better responsible investor. We had 276 individual equity and bond mandates at the end of the year, of which 114 were assigned to external equity managers. This approach ensures precise management and control of risk, performance measurement, costs and incentives for each investment mandate.

The fund’s investments in real estate and unlisted renewable energy infrastructure are not part of the benchmark index from the Ministry. These investments are funded by selling equities and bonds from the benchmark index. Which equities and bonds are sold depends on the country and currency in which the investment is made. The relative return for equity and bond management is measured against the benchmark index adjusted for the equities and bonds sold to fund investments in real estate and unlisted renewable energy infrastructure. The return on real estate and infrastructure investments is measured against the equities and bonds sold to fund them.

In 2024, the fund’s return was 0.45 percentage point lower than the return on the benchmark index. However, the fund has outperformed the benchmark index by 0.25 percentage point annually since 1998, 0.26 percentage point over the past decade, and 0.29 percentage point over the past five years.

TABLE 18 Relative return in 2024.

|

Percentage points |

|

|---|---|

|

Fund |

-0.45 |

|

Equity investments |

-0.47 |

|

Fixed-income investments |

0.21 |

Equity management

Equity management is measured against the equity portion of the benchmark index, adjusted for sales of equities to fund investments in real estate and renewable energy infrastructure. The return on equity management was 0.20 percentage point lower than on this adjusted benchmark in 2024 and contributed -0.13 percentage point to the fund’s total relative return. Investments in telecommunications and technology made the greatest negative contributions, while investments in consumer goods and health contributed positively. Broken down by country, equity investments in the US, Switzerland and China made the most negative contributions, while those in Singapore and Taiwan contributed positively.

Equity management has outperformed the benchmark index by 0.45 percentage point annually since 1999, 0.39 percentage point over the past decade, and 0.50 percentage point over the past five years.

CHART 20 Annual relative return and accumulated annualised relative return in percentage points. Calculations based on aggregated equity and fixed-income investments until end of 2016.

Fixed-income management

Fixed-income management is measured against the bond portion of the benchmark index, adjusted for sales of bonds to fund investments in real estate and renewable energy infrastructure. The return on fixed-income management was 0.18 percentage point higher than on this adjusted benchmark index in 2024 and contributed 0.05 percentage point to the fund’s relative return. The management of fixed-income instruments in developed markets made the greatest positive contribution, but investments in corporate bonds also contributed positively. The fund also invests in bonds issued by the authorities in emerging markets. Interest rates in Latin America rose considerably during the year, pulling down the relative return.

Fixed-income management has outperformed the benchmark index by 0.24 percentage point annually since 1998, 0.37 percentage point over the past decade, and 0.65 percentage point over the past five years.

Real estate

The fund’s overall strategy for real estate covers both unlisted and listed real estate investments. The relative return for real estate management is measured as the difference between the return on the fund’s total real estate investments and the return on the bonds and equities sold to buy them. Real estate management contributed -0.26 percentage point to the fund’s relative return in 2024. Unlisted investments contributed -0.13 percentage point, with investments in all three regions – the US, Europe and Asia – making negative contributions, especially those in the US office segment. Listed real estate investments also contributed -0.13 percentage point, the greatest negative contributions coming from investments in the US.

We report unlisted real estate returns quarterly and annually, but it is important to assess the real estate strategy over a longer period. From the fund’s first unlisted real estate investment in 2011 through to the end of 2016, the annual return on unlisted real estate investments was 5.98 percent. During this period, real estate investments were funded by selling bonds. The annual return on bond investments in the same period was 4.37 percent. From 2017 to 2024, the annual return on the unlisted real estate investments was 2.55 percent. During this period, unlisted real estate was funded through sales of equities as well as bonds. The annual return on this funding in the same period was 4.03 percent.

Unlisted renewable energy infrastructure

The fund’s strategy is to build up a portfolio of high-quality large-scale wind and solar power generation assets. The relative return for renewable energy infrastructure is measured as the difference between the return on the fund’s total investments in these assets and the return on the bonds sold to fund them. The fund’s investments in renewable energy infrastructure returned -9.81 percent in 2024, driven by a higher cost of capital. From inception, the strategy has produced an annual return of 0.66 percent.

TABLE 19Relative return on the fund's asset management in percentage points.

|

Year |

Fund1 |

Equity management2 |

Fixed-income management2 |

Real estate management2 |

Infrastructure management |

|---|---|---|---|---|---|

|

2024 |

-0.45 |

-0.20 |

0.18 |

-6.72 |

-7.35 |

|

2023 |

-0.18 |

0.38 |

0.51 |

-10.51 |

-5.67 |

|

2022 |

0.87 |

0.52 |

1.68 |

0.22 |

25.09 |

|

20213 |

0.75 |

0.78 |

-0.04 |

7.36 |

8.04 |

|

2020 |

0.27 |

0.98 |

0.76 |

-13.81 |

|

|

2019 |

0.23 |

0.51 |

0.11 |

-3.89 |

|

|

2018 |

-0.30 |

-0.69 |

-0.01 |

5.49 |

|

|

2017 |

0.70 |

0.79 |

0.39 |

0.70 |

|

|

2016 |

0.15 |

0.15 |

0.16 |

||

|

2015 |

0.45 |

0.83 |

-0.24 |

||

|

2014 |

-0.77 |

-0.82 |

-0.70 |

||

|

2013 |

0.99 |

1.28 |

0.25 |

||

|

2012 |

0.21 |

0.52 |

-0.29 |

||

|

2011 |

-0.13 |

-0.48 |

0.52 |

||

|

2010 |

1.06 |

0.73 |

1.53 |

||

|

2009 |

4.13 |

1.86 |

7.36 |

||

|

2008 |

-3.37 |

-1.15 |

-6.60 |

||

|

2007 |

-0.24 |

1.15 |

-1.29 |

||

|

2006 |

0.14 |

-0.09 |

0.25 |

||

|

2005 |

1.06 |

2.16 |

0.36 |

||

|

2004 |

0.54 |

0.79 |

0.37 |

||

|

2003 |

0.55 |

0.51 |

0.48 |

||

|

2002 |

0.30 |

0.07 |

0.49 |

||

|

2001 |

0.15 |

0.06 |

0.08 |

||

|

2000 |

0.27 |

0.49 |

0.07 |

||

|

1999 |

1.23 |

3.49 |

0.01 |

||

|

1998 |

0.18 |

0.21 |

1 Includes real estate management from 2017. The fund's relative return prior to 2017 is calculated on equity and fixed-income management only.

2 Measured against actual funding from 2017. The relative return on equity and fixed-income management before 2017 is measured against the respective Ministry of Finance asset class indices.

3 The relative return on the fund and fixed-income management for 2021 have been adjusted by 0.01 percentage point as a result of an update of the return on the benchmark index.

Investment strategies

We employ a range of investment strategies in our management of the fund. They are grouped into three main strategies – market exposure, security selection and fund allocation – which are pursued across equity, fixed-income and real asset management.

The market exposure strategy consists of positioning and securities lending, and contributed 0.07 percentage point to the fund’s relative return in 2024. Positioning is about implementing market exposures in ways that increase investment returns and reduce transaction costs. This is done partly by exploiting relative valuations across instruments and issuers, and the pricing effects of company and market events. This includes positioning based on interest rate levels, inflation, exchange rates and interest rate differentials between countries. Equity positioning contributed -0.01 percentage point to the relative return in 2024, with the greatest negative contribution from US equities. Investments in Europe made a positive contribution. Fixed-income positioning contributed 0.05 percentage point to the fund’s relative return, with positive contributions from all regions. Securities lending contributed 0.04 percentage point to the fund’s relative return, most of which came from lending out equities.

The security selection strategy is based on company analysis covering the fund’s largest investments. The aim is to improve returns and enhance our role as a responsible and active owner. This strategy contributed -0.06 percentage point to the fund’s relative return in 2024. Internal equity selection contributed -0.13 percentage point. North American stocks made the most negative contribution here, especially investments in telecommunications and technology companies, while investments in financials made the most positive contribution. External equity selection contributed 0.07 percentage point to the fund’s relative return. Markets in the Middle East and South Africa contributed positively, while investments in Latin America and developed markets in Europe pulled the other way. When it comes to fixed-income management, security selection focuses on corporate bonds. This strategy contributed 0.01 percentage point to the fund’s relative return in 2024.

The fund allocation strategy consists of a number of strategies that aim to improve the trade-off between return and risk in the fund over time. This strategy contributed -0.46 percentage point to the fund’s relative return in 2024.

Investments in real estate and renewable energy infrastructure are reported under fund allocation in our strategy reporting. Investments in real estate contributed -0.26 percentage point to the fund’s relative return in 2024, and investments in renewable energy infrastructure -0.01 percentage point.

During the year, the fund was underweight in equities and overweight in bonds, especially in emerging markets. We also had a smaller allocation to the largest US technology companies than the benchmark index. Taken together, these allocation decisions made a contribution of -0.20 percentage point to the relative return.

TABLE 20 Contributions to the fund's relative return from investment strategies in 2024. In percentage points.

|

Equity management |

Fixed-income management |

Real assets management |

Allocation |

Total |

|

|---|---|---|---|---|---|

|

Market exposure |

0.02 |

0.05 |

0.00 |

0.07 |

|

|

Asset positioning |

-0.01 |

0.05 |

0.00 |

0.03 |

|

|

Securities lending |

0.03 |

0.00 |

0.04 |

||

|

Security selection |

-0.06 |

0.01 |

-0.06 |

||

|

Internal security selection |

-0.13 |

0.01 |

-0.12 |

||

|

External security selection |

0.07 |

0.07 |

|||

|

Fund allocation |

-0.09 |

0.00 |

-0.26 |

-0.11 |

-0.46 |

|

Real estate |

-0.26 |

-0.26 |

|||

|

Unlisted real estate |

-0.13 |

-0.13 |

|||

|

Listed real estate |

-0.13 |

-0.13 |

|||

|

Renewable energy infrastructure |

-0.01 |

-0.01 |

|||

|

Allocation |

-0.09 |

0.00 |

-0.11 |

-0.20 |

|

|

Total |

-0.13 |

0.05 |

-0.26 |

-0.11 |

-0.45 |

TABLE 21 Contributions to the fund's relative return from investment strategies annualised for 2013–2024. In percentage points.

|

Equity management |

Fixed-income management |

Real assets management |

Allocation |

Total |

|

|---|---|---|---|---|---|

|

Market exposure1 |

0.10 |

0.07 |

0.00 |

0.17 |

|

|

Asset positioning |

0.06 |

0.06 |

0.00 |

0.13 |

|

|

Securities lending |

0.04 |

0.01 |

0.05 |

||

|

Security selection |

0.14 |

0.01 |

0.15 |

||

|

Internal security selection |

0.05 |

0.01 |

0.06 |

||

|

External security selection |

0.09 |

0.09 |

|||

|

Fund allocation |

-0.01 |

-0.01 |

-0.07 |

-0.01 |

-0.10 |

|

Real estate |

-0.07 |

-0.07 |

|||

|

Unlisted real estate |

-0.01 |

-0.01 |

|||

|

Listed real estate |

-0.06 |

-0.06 |

|||

|

Renewable energy infrastructure |

0.00 |

0.00 |

|||

|

Allocation2,3 |

-0.01 |

-0.01 |

0.00 |

-0.01 |

-0.02 |

|

Total |

0.23 |

0.07 |

-0.07 |

0.00 |

0.23 |

1 Market exposure includes -0.01 percentage point from the systematic factors strategy which was ended in the second quarter of 2020.

2 Regulations for Environmental related mandates for equities and fixed income were changed by the Ministry of Finance during 2022. The historic performance impact from Environmental related mandates until 2022 is included under Allocations. impact from Environmental related mandates until 2022 is included under Allocations.

3 Specific allocation to Systematic factors was ended in 2022. The historic performance impact from Systematic factors is included under Allocations.

Risk relative to the benchmark index

The fund is invested differently to its benchmark index along various dimensions, including asset classes, currencies, sectors, countries, regions, individual stocks and individual bond issuers.

At the end of 2024, the equity portfolio was overweight in high-volatility stocks and stocks with lower dividend yields relative to the benchmark index. The fixed-income portfolio had less exposure to corporate bonds than the benchmark index, but greater exposure to bonds from emerging markets and government-related bonds. The fund had 364 billion kroner invested in unlisted real estate and 359 billion kroner in listed real estate at the end of the year. Real estate investments were among the fund’s largest relative exposures.

The Ministry of Finance and Norges Bank’s Executive Board have set limits for how far the fund’s investments may deviate from the benchmark index. One of these limits is expected relative volatility, or tracking error, which puts a ceiling on how much the return on the fund’s investments can be expected to deviate from the return on the benchmark index. The management mandate requires all of the fund’s investments to be included in the calculation of expected relative volatility and measured against the benchmark index, which consists solely of global equity and bond indices. The fund is to aim for expected relative volatility of no more than 1.25 percentage points. The actual level at the end of 2024 was 0.44 percentage point, up from 0.34 percentage point a year earlier. The increase was due mainly to higher expected relative volatility in equity investments.

We invest in real estate to spread the fund’s risk, as real estate investments are expected to have a different return profile to equities and bonds in both the short and the long term. This has an impact on the calculation of the fund’s expected relative volatility. As daily pricing is not available for our unlisted real estate investments, we use a model from MSCI to calculate the relative risk for these investments.

Norges Bank’s Executive Board has also set a limit for the expected shortfall between the return on the fund and return on the benchmark index in extreme situations. This limit has been set at 3.75 percentage points. The actual figure at the end of 2024 was 1.18 percentage points, up from 1.08 percentage points a year earlier.

TABLE 22Key figures for the fund's risk and exposure.

|

Limits set by the Ministry of Finance |

31.12.2024 |

|

|---|---|---|

|

Allocation |

Equity portfolio 60–80 percent of fund's market value1 |

71.4 |

|

Unlisted real estate no more than 7 percent of the fund's market value |

1.8 |

|

|

Fixed-income portfolio 20–40 percent of fund's market value1 |

27.7 |

|

|

Unlisted renewable energy infrastructure no more than 2 percent of the fund's market value |

0.1 |

|

|

Market risk |

1.25 percentage points expected relative volatility for the fund's investments |

0.4 |

|

Credit risk |

Maximum 5 percent of fixed-income investments may be rated below BBB- |

1.0 |

|

Emerging markets |

Maximum 5 percent of fixed-income investments may be in emerging markets |

2.7 |

|

Ownership |

Maximum 10 percent of voting shares in a listed company in the equity portfolio2 |

9.6 |

1 Derivatives are represented with their underlying economic exposure.

2 Investments in listed and unlisted real estate companies are exempt from this restriction.

CHART 21 Expected relative volatility of the fund in basis points.

TABLE 23Expected relative volatility of investment strategies as at 31 December 2024. Each strategy measured stand-alone with the other strategies positioned in line with the benchmarks. All numbers measured at fund level in basis points.

|

Equity management |

Fixed-income management |

Real assets management |

Allocation |

Total |

|

|---|---|---|---|---|---|

|

Market exposure |

6 |

3 |

0 |

6 |

|

|

Asset positioning |

6 |

3 |

0 |

6 |

|

|

Security selection |

17 |

2 |

17 |

||

|

Internal security selection |

15 |

2 |

14 |

||

|

External security selection |

8 |

8 |

|||

|

Fund allocation |

11 |

4 |

37 |

8 |

46 |

|

Real estate |

37 |

37 |

|||

|

Unlisted real estate |

20 |

20 |

|||

|

Listed real estate |

24 |

24 |

|||

|

Renewable energy infrastructure |

3 |

3 |

|||

|

Allocation |

11 |

4 |

8 |

18 |

|

|

Total |

19 |

5 |

37 |

8 |

44 |

Our employees are the heart of our business

Our people are our most important asset. We need to attract, develop and retain leading talent. We aim to ensure that everyone can work efficiently and innovatively and has the skills to take on new challenges.

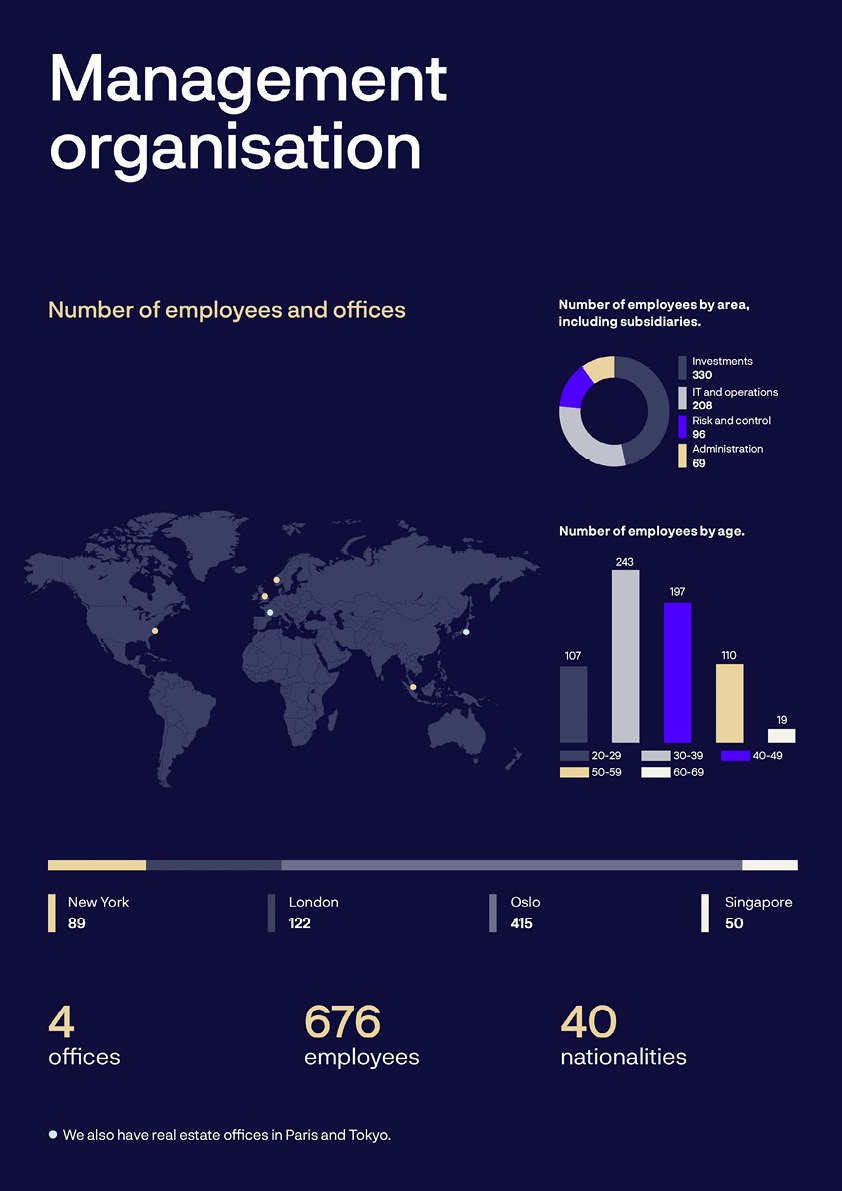

We are a global investment organisation. At the end of 2024, we had 676 employees across our offices in Oslo, London, New York and Singapore. We also have real estate offices in Paris and Tokyo. Close collaboration across these offices is essential for achieving the fund’s objective of the highest possible return.

Learning and development opportunities

We believe in lifelong learning and give employees the chance to build relevant skills throughout their careers. We work systematically on developing leaders and other staff by offering a variety of learning and development opportunities. We have a continuous development process where employees and their managers set clear targets and expectations together. To promote co-operation, efficiency and a performance culture, we decided in 2024 to reduce the option of working from home from two days per week to one day of the employee’s choosing.

We launched a new internal strategy during the year for how AI can make us more efficient, improve our risk management and help us achieve the highest possible return. These goals are anchored in Norges Bank’s Strategy 25 and are to contribute to the fund’s long-term results. We secured access to leading AI models during the year and strengthened our collaboration with suppliers of language models. For the first time, we arranged tech days at all of our offices to raise skills levels. In internal surveys, employees report that AI tools have increased their productivity by an average of 15 percent.

For the second year, we held an Investment Academy to boost investment skills, value chain understanding and collaboration across the organisation. The programme is led by our own experts, and feedback has been very positive. In addition, we organised eight lectures on the geopolitical landscape, power dynamics and their financial implications, focusing on topics such as energy, renewable infrastructure and technology. We also held workshops where employees were given tools to deal with complex information, improve the learning process and use AI to support learning.

Our learning platform offers digital courses tailored to our organisation. We also offer employees access to 7,000 courses from leading universities and organisations, and arrange annual courses on coding and AI.

Feedback is a key part of our organisation culture and is important for professional development. We offer training in giving and receiving feedback, and employees undergo 360 degree reviews annually where they receive constructive feedback from their colleagues. A total of 11,500 pieces of feedback were given in 2024. We also launched a mentoring scheme to encourage new perspectives across teams and support personal development.

Our leaders are crucial in building a strong learning culture. They set direction, provide guidance and encourage innovation. We make clear expectations of them and arrange regular forums, including annual meet-ups. New leaders complete an introduction programme, and all leaders receive training on topics such as psychological safety, feedback, stress management and mental resilience.

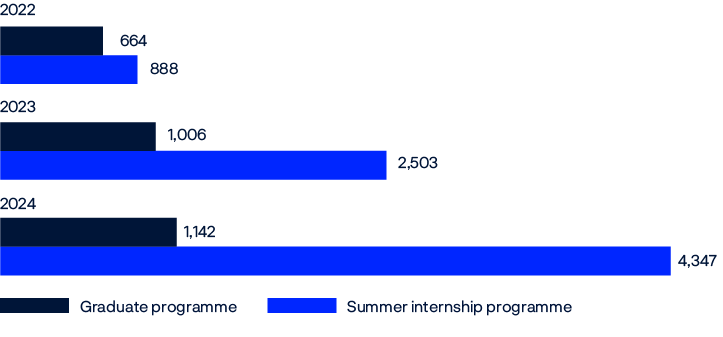

Information and recruitment

We are keen to give young people a better understanding of the world of finance. In 2024, we gave 31 guest lectures at universities in Norway and abroad. The aim was to give students an insight into investment management in practice, increase knowledge about the fund and share our expertise with a younger target group.

We work systematically to recruit the best candidates both in Norway and internationally, and seek talented individuals with varied skills and backgrounds. We saw a significant increase in the number of applicants for our vacancies from 2023 to 2024, including record-high applications for our graduate and summer internship programmes. For the first time, we accepted summer interns at our New York office.

CHART 22 Number of applications for our graduate and summer internship programmes.

Diversity, equality and working environment

We aim to be an inclusive organisation with a diversity of mindsets, ethnicities, age groups, academic backgrounds and life experience. This brings a broader perspective, increases creativity and enables us to make better decisions.

We have extended our range of social activities to encourage a greater sense of community. We marked various international awareness days and events during the year, including Pride, International Women’s Day and World Mental Health Day. We also started up a network of mental health first aiders at all of our offices as one of many initiatives to promote a working environment where people can safely express their views and learn from their mistakes.

We are working actively to increase the share of women in the organisation as a whole and in senior management positions. In 2024, we supported the launch of an investment club for women to inspire and motivate more to choose a career in finance. Norges Bank was also one of the founders of the Women in Finance Charter and hosted the work on charter’s fourth status report in 2024. Our target is at least 40 percent women in Norges Bank as a whole, in senior management positions and in specialist positions. Our obligations under the charter’s four principles can be found at our website. Although we have a healthy gender balance in some areas, we still have some way to go to increase the proportion of women in senior management positions and senior specialist positions.

TABLE 24 Gender balance by management level as at 31 December 2024. In percent.

|

Grade |

Women |

Men |

|---|---|---|

|

Management level 1 (Chief) |

55 |

45 |

|

Management level 2 (Global Head) |

13 |

87 |

|

Management level 3 (Head) |

31 |

69 |

|

Specialised positions (level 4 and 5) |

22 |

78 |

Our continuous efforts to increase the representation of women are reaping rewards: retention of female employees has improved, and the share of female applicants for our vacancies has increased.

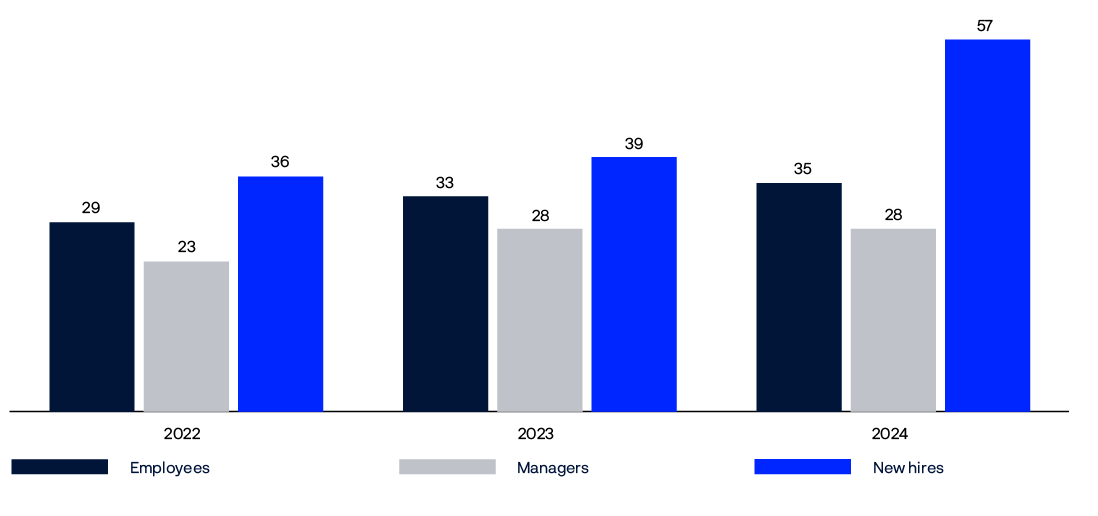

CHART 23 Share of employees, managers and new hires who are women, in percent.

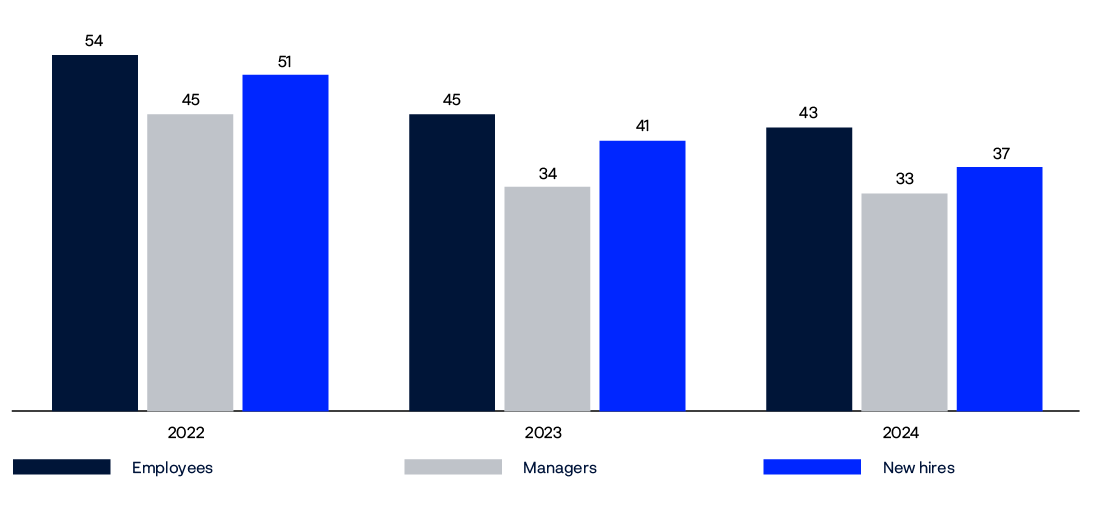

CHART 24 Share of employees, managers and new hires who are non-Norwegian, in percent.

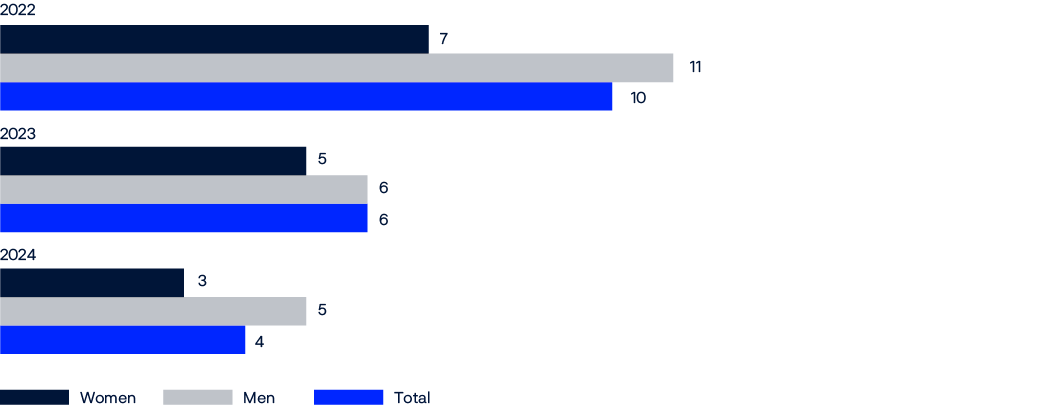

CHART 25 Employees who ended their employment, by gender in percent.

To ensure that we are consistent and fair in our approach to employees’ progression, promotion and remuneration, different areas of the organisation have their own career ladders. Each ladder can have up to five different grades with consistent job titles. Each grade reflects the expectations associated with the role that are to be met regardless of which area the employee works in.

TABLE 25 Gender balance by grade and office as at 31 December 2024. In percent.

|

Grade |

Oslo |

London |

New York |

Singapore |

||||

|---|---|---|---|---|---|---|---|---|

|

Share of employees |

Share of employees |

Share of employees |

Share of employees |

|||||

|

Men |

Women |

Men |

Women |

Men |

Women |

Men |

Women |

|

|

Global Head |

83 |

17 |

100 |

0 |

100 |

0 |

100 |

0 |

|

Head |

67 |

33 |

62 |

38 |

82 |

18 |

100 |

0 |

|

Level 5 |

100 |

0 |

89 |

11 |

67 |

33 |

0 |

100 |

|

Level 4 |

77 |

23 |

73 |

27 |

88 |

12 |

67 |

33 |

|

Level 3 |

59 |

41 |

59 |

41 |

60 |

40 |

78 |

22 |

|

Level 2 |

64 |

36 |

33 |

67 |

62 |

38 |

63 |

38 |

|

Level 1 |

37 |

63 |

60 |

40 |

100 |

0 |

33 |

67 |

Our 2024 people survey revealed high levels of engagement in the workforce. Employees see their work as meaningful, are proud of their workplace and thrive at Norges Bank Investment Management, regardless of gender, age or nationality. A growing number report that they are satisfied with the development opportunities available to them, which they report as the most important driver of motivation and well-being.

Remuneration system

Norges Bank’s Executive Board sets limits for our remuneration system and monitors its implementation. Pay levels are to be competitive but generally not market-leading. Salaries are set individually and reflect the position’s responsibilities and the employee’s skills, experience and achievements. Total remuneration paid includes fixed salary and any performance-based pay, overtime pay and travel time pay.

In keeping with the management mandate from the Ministry of Finance, the remuneration system complies with the requirements of the regulations issued under the Securities Funds Act with necessary adjustments. The Executive Board’s Remuneration Committee is to contribute to thorough and independent consideration of matters concerning Norges Bank’s remuneration arrangements. Norges Bank’s Internal Audit unit also issues an independent statement on compliance with rules and guidelines on remuneration. The review in 2024 confirmed that the remuneration system was operated in line with applicable rules in 2023.

TABLE 26 Fixed salary and other key information for senior management in 2024.

|

Position |

Name |

Gender |

Investment area |

Age |

Tenure in Norges Bank Investment Management |

Annual fixed salary in kroner |

|---|---|---|---|---|---|---|

|

Chief Human Resources Officer |

Aass, Ada Magnæs |

Woman |

45 years |

10 years |

2,440,000 |

|

|

Co-Chief Investment Officer Equities |

Balthasar, Daniel1 |

Man |

Investment area |

48 years |

18 years |

13,670,000 |

|

Chief Technology and Operating Officer |

Bryne, Birgitte |

Woman |

52 years |

9 years |

4,250,000 |

|

|

Co-Chief Investment Officer Equities |

Furtado Reis, Pedro1 |

Man |

Investment area |

49 years |

13 years |

13,670,000 |

|

Deputy Chief Executive Officer/Chief of Staff |

Grande, Trond |

Man |

54 years |

17 years |

5,380,000 |

|

|

Chief Investment Officer Real Asset |

Holstad, Mie Caroline |

Woman |

Investment area |

42 years |

14 years |

3,620,000 |

|

Chief Risk Officer |

Huse, Dag |

Man |

58 years |

21 years |

5,005,000 |

|

|

Chief Governance and Compliance Officer |

Ihenacho, Carine Smith1 |

Woman |

62 years |

7 years |

6,828,000 |

|

|

Co-Chief Investment Officer Asset Strategies |

Norberg, Malin |

Woman |

Investment area |